InfuSystem

Holdings, Inc. Shareholder Presentation

December 1, 2014

Exhibit 99.1 |

InfuSystem

Holdings, Inc. Shareholder Presentation

December 1, 2014

Exhibit 99.1 |

Safe Harbor

Statement Certain statements contained in this presentation are forward-looking

statements and are based on future expectations, plans and prospects for the business

and operations of InfuSystem Holdings, Inc. (“InfuSystem” or “the

Company”) that involve a number of risks and uncertainties. In connection with the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995, the Company is identifying

certain factors that could cause actual results to materially differ from those

indicated by these forward-looking statements. Those factors, risks and

uncertainties include, but are not limited to: potential changes in overall healthcare

reimbursement, including CMS competitive bidding; sequestration; concentration of customers;

increased focus on early detection of cancer; competitive treatments; dependency on

Medicare Supplier Number; availability of chemotherapy drugs; global financial

conditions; changes and enforcement of state and federal laws; dependency on suppliers;

risks associated with acquisitions and joint ventures, including integration risks; US

Healthcare Reform; relationships with healthcare professionals and organizations; technological

changes related to infusion therapy; [dependency on websites and intellectual property;

dependency on key personnel; dependency on banking relationships; risks associated with

our common stock, as well as any litigation to which the Company may be subject from

time to time; and other risk factors as discussed in the Company’s annual report

on Form 10-K for the year ended December 31, 2013 and in subsequent filings

made by the Company from time to time with the Securities and Exchange Commission (the

“SEC”), which can be obtained via the SEC’s Edgar website or by

contacting the Company or the SEC. Forward-looking statements in this

presentation are made as of December 1, 2014, and, unless required by law, the Company

disclaims any duty to supplement, update or revise such statements, whether as a result of

subsequent developments, changed expectations or otherwise. The Company regularly

posts important information to the investors section of its website.

|

Summary

InfuSystem is a growing healthcare company that

provides infusion pumps and related products and

services for patients in the home, in oncology clinics,

ambulatory surgery centers, and other sites of care

from five locations serving all 50 States and

Canada.

We deliver improved patient satisfaction

and outcomes with world-class quality, both in and

out of the home environment.

The company's

market share and profitable growth is predicated on

expansion into new therapies, increased use of

electronic connectivity, development of new

products and services, and strategic geographic

expansion.

Confidential Information of InfuSystem Holdings, Inc.

3 |

InfuSystem

- “Infusion Made Easy”

9 mos YTD September 30, 2014

(1)

Revenues $50.2M (Up 11%)

AEBITDA $11.5M (Up 2%)

Market Cap $64.0M @ $2.87 (as of

11/20/14)

Company Overview

Provides infusion pumps and related

products and services for patients in:

The Patient’s Home

Oncology Clinics

Ambulatory Surgery Centers

And Other Sites of Care

Serves all 50 States & Canada

from 5 locations

Improves outcomes and delivers high

patient satisfaction with world-class ISO

and CHAP accredited quality

Profitable growth is predicated on:

Growth of oncology and orthopedic

surgery

Increased electronic connectivity

New products and services

Strategic geographic expansion

(1) Free Cash Flow = Adjusted EBITDA less CapEx and Purchases of

Medical Equipment

“The right pump, the right place, and the right time.

Working and patient ready.” |

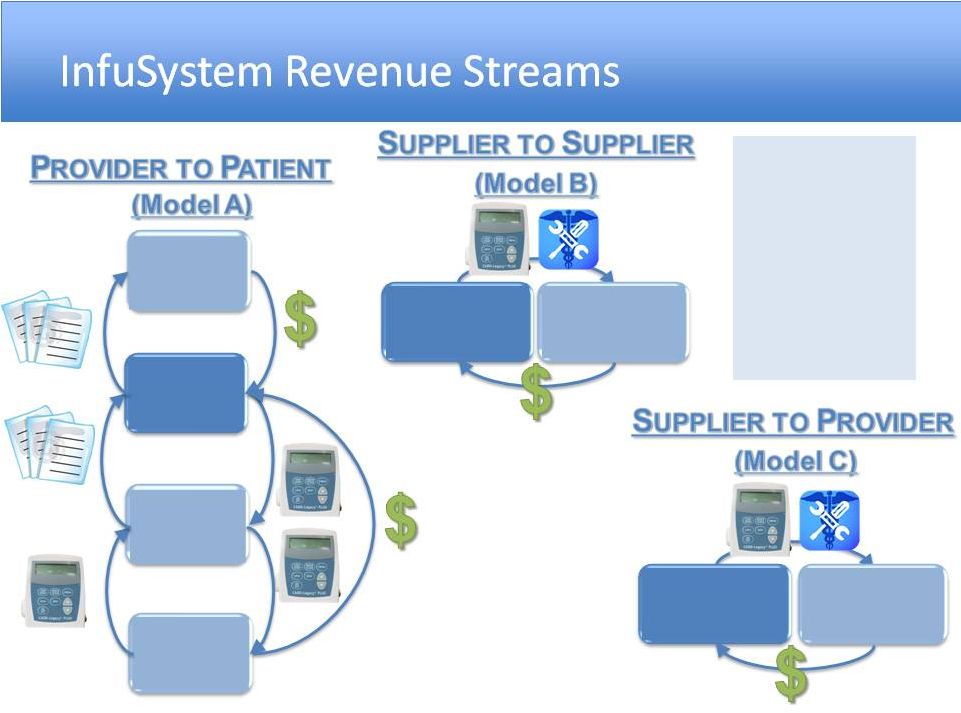

InfuSystem

Manufacturer,

Rental

Companies

Insurance

Company

InfuSystem

Clinic

Patient

InfuSystem

Clinic, Hospital,

Home Infusion

Sales &

Sales &

Rental

Rental

revenue

revenue

via 3

via 3

revenue

revenue

streams.

streams.

Patient

Co-pay &

Deductible |

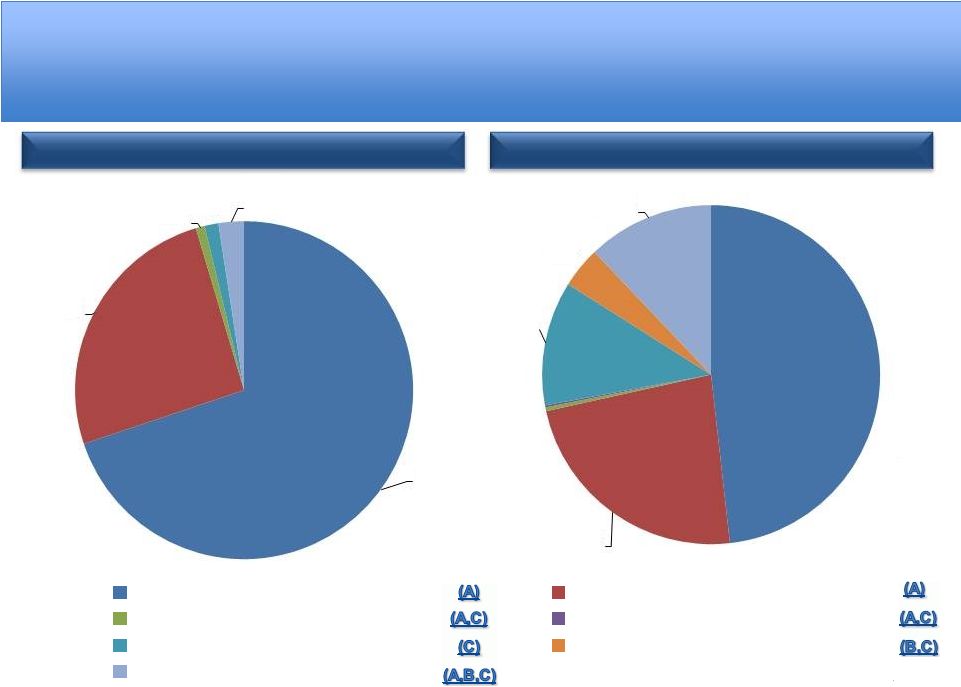

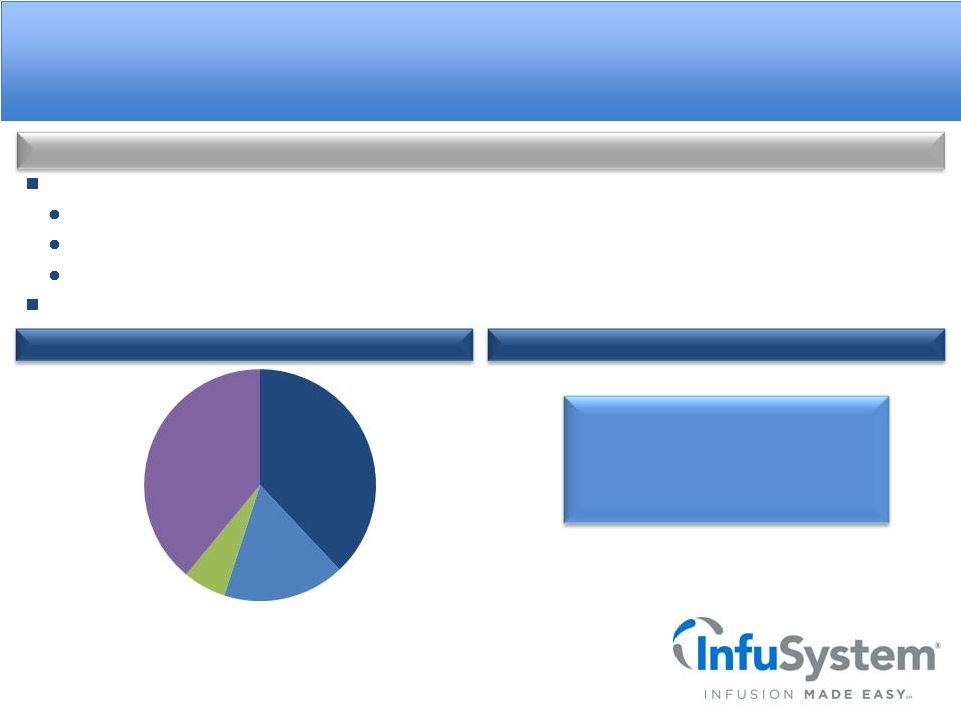

Revenue

Diversification 2009 Revenues $39M

2014 Revenues (Annualized 9m)

70%

26%

1%

1%

2%

48%

23%

12%

4%

12%

Rentals -

Colorectal Cancer

Rentals -

Other Cancers

Rentals -

Infectious Disease

Rentals -

Pain Management

Rentals -

Hospitals/Home Care

Rentals -

Service & Repair

Sales -

Equip, Consumables |

InfuSystem

Provider Niche – Therapy Started in

Clinic

Total

Total

Home

Home

Infusion

Infusion

Market

Market

Chemotherapy at Home

InfuSystem is the market

leader with over 1,600

practice sites served

Estimated over $200 M

market.

Cancer rates growing

Nerve Block at Home

5.69M orthopedic

surgeries annually

50% are projected to be

Continuous Peripheral

Nerve Block Candidates

Estimated $700 M

market

Growing therapy |

Electronic

Connectivity through Electronic Medical Record (EMR) Interface

Electronic

Data

Exchange

Interface Effects

Fuels market share

gains

Efficiency advantage

vs smaller players

Greater revenue per

employee

Greater customer

satisfaction |

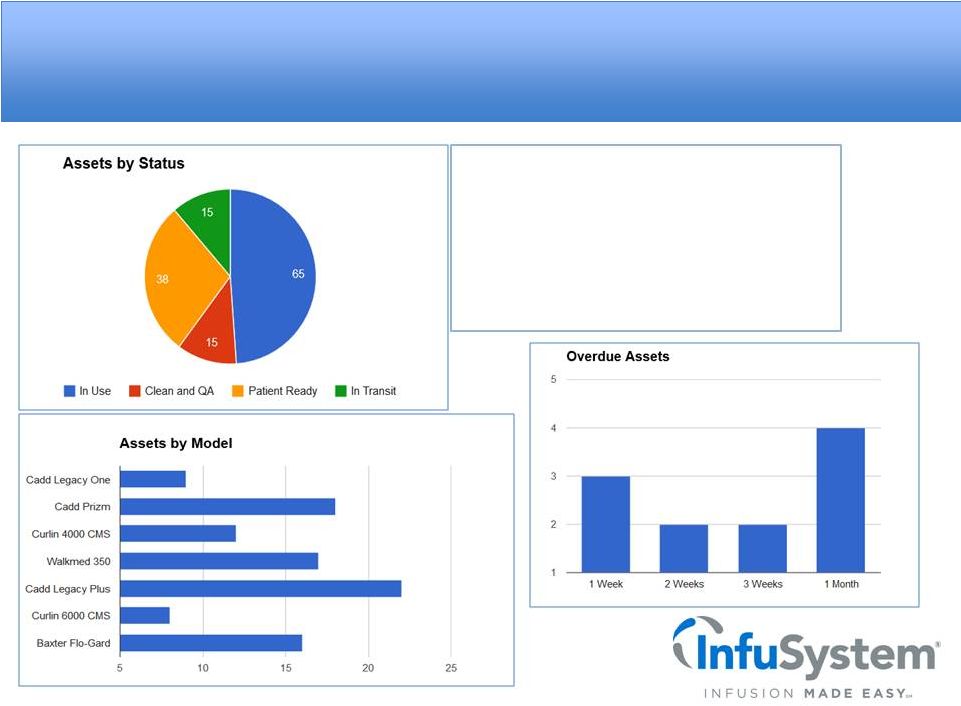

Lifecycle

Management – Infusion Pumps

Total Pump Fleet Management

•

Online, Anytime

•

Order New Pumps

•

Schedule Service & Repair

•

Access Recertification Docs |

Lifecycle

Management – Asset Tracking

Smart Metrics

Loss Threat Count

11

Loss Threat Percent

3%

Assets Under Par

7

30 Day Average Daily Check-Outs

6 |

High Patient

Satisfaction Scores |

For Faster

Turnaround and Improved Utilization Kansas City

Service Center

Madison Heights

Service Center

Future Northeast

Service Center

Future Southeast

Service Center

Los Angeles Area

Service Center

Houston

Service Center

Toronto Canada

Service Center

InfuSystem Distribution

Reduced cost of air

shipments

Improved

utilization of pumps

Increased market

share of same-day

rental market |

New Products

& Services Pain Management Service

Catheter care kits

Pole-mounted pump sales

and rentals in oncology

Smart Pump Services

Infusion disposals including

IV administration sets &

chemo safety |

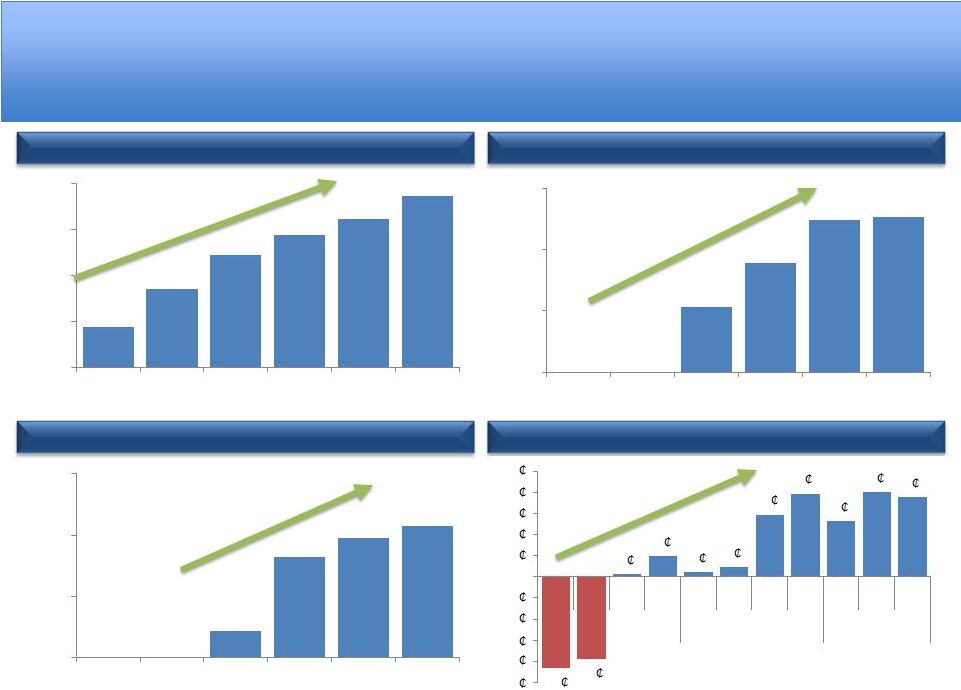

Financial

Overview Adjusted EBITDA (1)

Revenues

Free Cash Flow (1)

Basic EPS

(1) Free Cash Flow = Adjusted EBITDA less CapEx and Net Purchases of Medical

Equipment $38,964

$47,229

$54,637

$58,828

$62,280

$67,404

$30m

$40m

$50m

$60m

$70m

FY2009

FY2010

FY2011

FY2012

FY2013

LTM 3Q14

Revenues

Growing

$10,256

$13,126

$15,962

AEBITDA

Growing

$16,153

$6m

$10m

$14m

$18m

FY2011

FY2012

FY2013

LTM 3Q14

(1) Per 8K filed 3/28/13 for yrs 2011 and 2012

$5,754

$10,568

$11,839

$12,604

$4m

$8m

$12m

$16m

FY2011

FY2012

FY2013

LTM 3Q14

FCF

Growing

0

1

0

0

3

4

3

4

4

(4)

(4)

(5)

(4)

(3)

(2)

(1)

1

2

3

4

5

1Q

2Q

3Q

4Q

1Q

2Q

3Q

4Q

1Q

2Q

3Q

FY 2012

FY 2013

FY 2014

EPS Profitable &

Growing |

Uses of Free

Cash Flow Every $1.00 invested in the rental fleet

returns ~$1.50 in revenue every year

for the life of the pump

Total Debt

PP&E and Medical Equipment in Service (at cost)

Unrestricted Liquidity

Medical Equipment Turnover Ratio |

Positioned For

Growth Market Trends

•

InfuSystem is uniquely

positioned to take efficient

advantage of growing

market trends in…

•

Oncology

•

Orthopedic surgery

•

Growth of home infusion

Leadership

•

Experienced Medical

Industry Executives

•

Focused on improving

patient satisfaction and

outcomes

•

Supported by World Class -

ISO and CHAPS Accredited -

facilities and motivated

employee

Strategy

•

Increased use of electronic

connectivity

•

Expanding geographic

footprint

•

Expanding into new

therapies, products and

services |

Where Does

This Take INFU? Aging Population and Cancer Growth

More Patients Home IV , Commercial Pay

Recognizing Value, CMS Competitive Bidding

Peripheral Nerve Block and Smart Pump Growth

Revenue Growth in High Single Digits Through 2015 |

Thank You for

Your Interest! IR Contact Info:

The Dilenschneider Group

212-922-0900

Rob Swadosh, rswadosh@dgi-nyc.com |

Appendix: INFU

Overview |

Increasing

Therapy Offerings to Payors Payor

Surgery

Infectious

Disease

Oncology

Special

Disease

States |

Full Line

Multi-Therapy & Multi-Point Offering HOW we provide TPP/DP/Service

Pumps Device & Pharma

Manufacturer,

Distributor, GPO, ACO

Partners

Provider

Patient

Payor |

InfuSystem

Niche – Extension of Clinic to Home

25-year old business model in

DME billing

At home, at work, at play, all

while receiving the drug

High satisfaction scores

24/7 on-call oncology nurses

Proven outcomes with

continuous home infusion

Oncology, Post Surgical Pain,

Special Disease States

Bills patient insurance

250+ Commercial and

Government Payor

Contracts

Commercial Payors

reimburse more

therapies than CMS

Awarded contracts in

all 9

MSAs (1 of 3

National Vendors)

Average cuts of ~21%

for our category, per

CMS ($250,000 per yr)

Ambulatory Home Infusion

TPP Payor Contracts |

Rentals, Sales

& Service to Providers Pump Experts

Direct sales, rental, and

lease of device and

supplies in US and

Canada

Pump Broker Expertise –

ability to acquire and

dispose of CAP EX in cost

effective way

Asset management,

rental and lease

Annual Pump

Recertification

Preventative

Maintenance

Warranty

World-Class ISO Certified

service facilities

Regional Distribution

West, South, East &

Canada

28+ Certified Technicians

Pump Rentals, Sales and

Asset Management

Preventative Maint.

Repair |

Offering

Infusion to All Points of Care Provider

Oncology

Acute

Care

Emergency

Services

Long Term

Care

Home

Infusion |

Compelling

Value Proposition In-House Service & Repairs

Convenience & Flexibility

Pre-Owned Equipment Expertise

One-Stop Shopping Solution

Convenience and flexibility of rentals and

financing minimize customer capital outlays

Rental and financing eliminates the need for

in-house maintenance/service

Option to own, rent or finance –

designed to fit

customers’

operating and financial parameters

Shorter and longer-term financing options

One-stop shopping solution for ambulatory large

volume pump and other movable medical devices

Sales

Rentals

Supplies

Service

Financing

World-class biomedical repair and

service for pumps, defibrillators and

most other general medical

equipment

Allows InfuSystem to purchase, clean,

repair and certify any used medical

equipment the Company buys for

subsequent sale, rental or financing to

customers

Complementary core competencies allow InfuSystem to offer superior selection, flexibility,

pricing and services “ONE-STOP SHOP”

SERVICE &

REPAIRS

CONVENIENCE &

FLEXIBILITY

PRE-OWNED

EQUIPMENT

EXPERTISE

Unique ability to source and deploy pre-

owned movable medical equipment

Consistent, fair and knowledgeable

market maker for pre-owned pump

disposals

Market knowledge results in attractive

equipment acquisition costs |

Payor &

Customer Mix Leading Cancer Institution Customers

Revenue by Payor (FY2013)

High diversification of providers and payors

No single healthcare provider represents more than 7% of Third-Party Payor revenues

Strong payor mix among Medicare, other commercial insurers, Blue Cross/Blue Shield, and

Medicaid Approximately 6% of revenues received directly from patients through

co-pays or otherwise Broad coverage further diversifies revenue streams

InfuSystem has strong relationships with the largest third-party payors and the leading

cancer institutions 9 of 10 of the Top

Ten Cancer

Treatment Centers

CMS: Centers for Medicare and Medicaid Services

Medicare and

Medicaid

38%

BCBS

17%

Patient

6%

Commercial

39% |

Infusion

pumps Enteral pumps

Direct Payor Business Model

Service & Repair

Products

InfuSystem sells, rents and finances a wide variety of new

and used large volume and ambulatory pumps

InfuSystem services and repairs both its own fleet of

pumps and many types of other movable medical

equipment

Syringe pumps

Ambulatory pumps

Large volume pumps

Ambulatory pumps

Fluid collection

Medical equipment

InfuSystem’s Direct Payor business is focused primarily on the sale, rental, financing

and accompanying service of movable

medical

equipment

to

hospitals

and

alternate

care

sites

who

pay

InfuSystem

directly

–

no

third-party

reimbursement

Founded in 1998 and headquartered in Olathe, KS with distribution/service centers in Santa Fe

Springs, CA and Mississauga, Ontario

InfuSystem services –

ISO 9001 -

and repairs movable medical equipment

Leading provider to alternate site healthcare facilities and hospitals in the United States

and Canada Home infusion providers, long-term care, physician clinics, research

facilities, etc. Transacts

directly

with

healthcare

providers

–

no

third-party

reimbursement

revenue |

InfuSystem

offers new pumps from top brands Broker-dealer trading desk

In addition, over 70 models and versions of pre-owned pumps

are offered

Pre-owned pumps are re-built and certified by in-house

biomedical technicians to be patient ready

Warranty offered on pre-owned pumps

A variety of financing options to fit customers’

operating,

budgeting and financing parameters

Nationwide, industry-leading ISO 9001 service programs

Launching branch service center in Houston

Direct Payor Offerings

Pre-Owned & New Pumps from Top Manufacturers

Full Spectrum of Ownership Options for Customers

Sales

Rental

Asset Management

Renting new or pre-owned equipment

Rent pumps by the day, week or month to

match swings in patient count

Free shipping on all rentals

Industry leader in sales of pre-owned

equipment, creating significant savings

Competitive pricing on new equipment

Option to sell back pre-owned pumps

Leasing plans offered

ISO 9001 Service offered

Service plans offered

Local service expansion

2 existing; 1 planned

Coordinate with TPP

Loaner pumps available

Leading Provider of New and Pre-Owned Pumps |

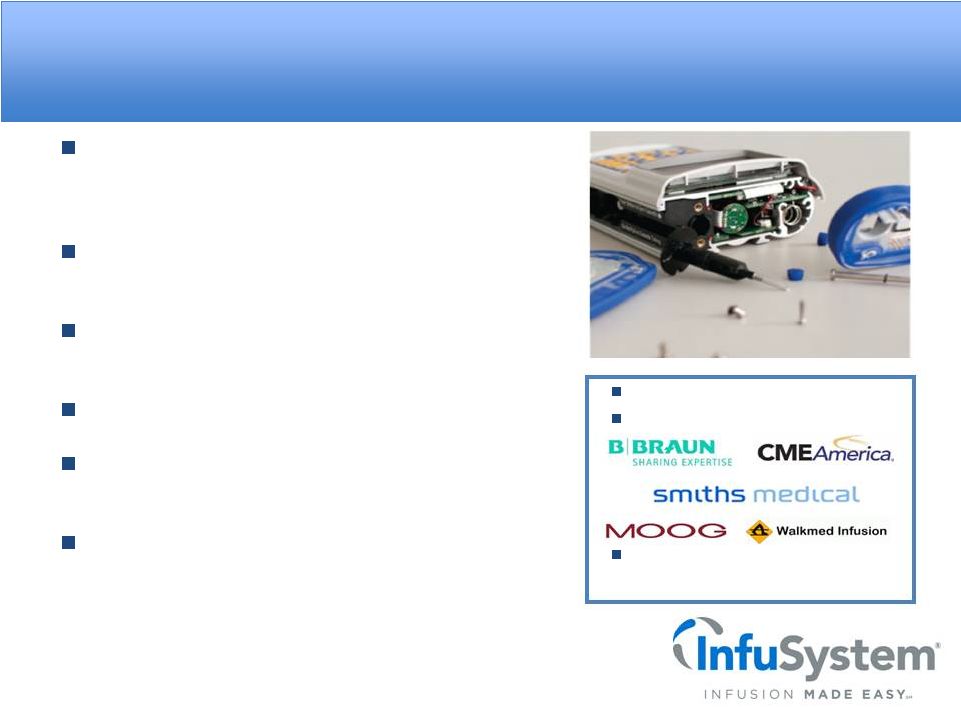

Medical

Equipment Service & Repair In addition to supporting and repairing

InfuSystem’s in-house fleet, the Company certifies,

recalibrates, repairs and services a variety of

infusion pumps

Pumps require scheduled maintenance and

calibration in accordance with manufacturer’s

specifications and regulatory guidelines

Service and repair capabilities on high demand

services reaching end of life that are no longer

supported by manufacturers

ISO certification and an established quality system

strengthens relationships with major customers

Provides InfuSystem an opportunity to establish a

business relationship with customers that acquired

pumps through other sources

Continuing and increased need for compliance

with current as well as anticipated regulations

28 highly qualified service technicians

5 major manufacturer relationships:

3 service centers, located in California,

Toronto and Kansas |

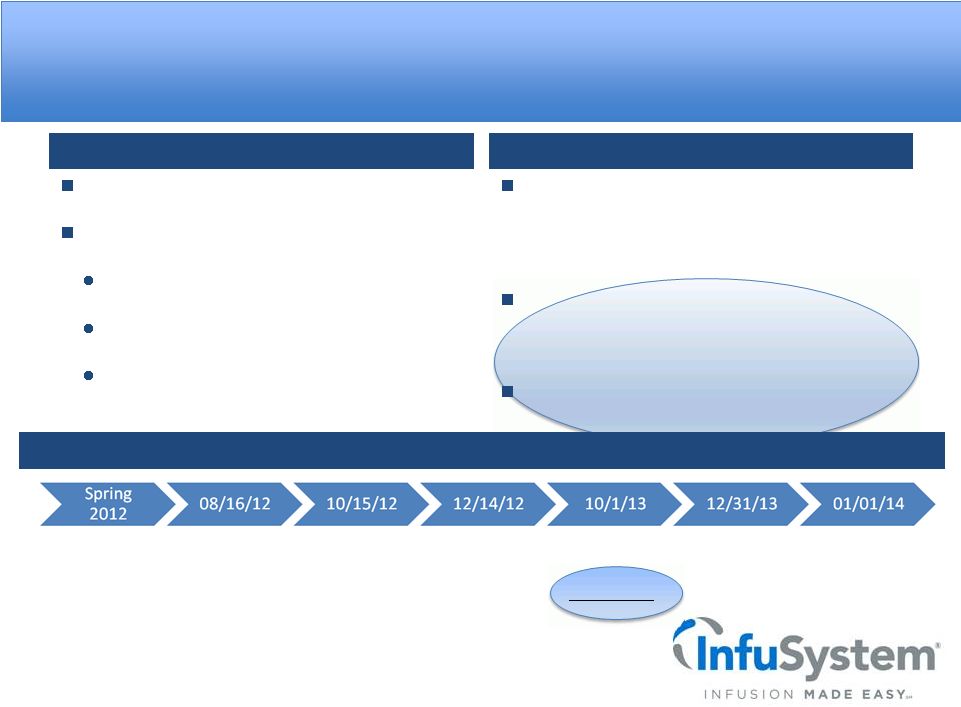

Competitive

Bidding Overview InfuSystem was not involved in Round 1 nor

Round 2 of Competitive Bidding

CMS announced a Recompete of Round 1

competitive bidding on April 17th

External infusion pumps/supplies added as a

new product category

A supplier must bid on all items within the

product category to have its RFP considered

Recompete covers 9 Metropolitan Statistical

Areas (MSAs)

Competitive Bidding Overview

InfuSystem’s Response to Competitive Bidding

InfuSystem has engaged consultants and industry

professionals to discuss directly with CMS, advise

on positioning the Company for potential

regulatory changes, and facilitate potential

strategic partnership opportunities

InfuSystem was awarded contracts in all 9 MSAs

with average cuts of ~21% for our category per

CMS. 1 of 3 National Vendors to receive

contracts in all 9 markets.

“Competitive environment will vary in accordance

with the level of cuts by CMS”

CMS Competitive Bidding “Target”

Timetable

CMS will institute some form of competitive

CMS will institute some form of competitive

bidding nationwide by January 2016.

bidding nationwide by January 2016.

CMS began the pre-

bidding supplier

awareness program

CMS announced bidding

schedule, start bidder

education and begin a

bidder registration period

Bid window

opens

Current Round 1 bid

contracts expire

CMS announces Round

1 Recompete bid

results –

INFU impact

$250K annually

Bid window

closes

Implementation of

Round 1 bid contracts

and prices |

Quarterly

Financial History Basic EPS |

Detailed

Historical P&L (000's)

12/31/09

12/31/10

12/31/11

12/31/12

12/31/13

9M 2013

9M 2014

Net revenues:

Rentals

46,795

$

53,471

$

55,962

$

41,556

44,150

Product sales

7,842

5,357

6,318

3,547

6,077

Net revenues:

38,964

47,229

54,637

58,828

62,280

45,103

50,227

Cost of Revenues:

Product, service and supply costs

6,200

7,730

9,128

9,165

11,274

8,174

9,024

Pump depreciation and loss on disposal

4,127

5,954

10,154

6,752

7,327

4,836

5,474

Gross Profit

28,637

33,545

35,355

42,911

43,679

32,093

35,729

Provision for doubtful accounts

4,006

4,515

4,099

5,251

6,534

4,782

4,811

Amortization of intangibles

1,827

2,259

2,662

2,734

2,618

1,972

1,876

Asset impairment charges

0

0

67,592

0

0

0

0

Selling and marketing

5,258

7,087

9,371

9,864

9,658

7,281

7,762

General and administrative

12,218

20,622

17,987

23,062

18,973

14,622

14,723

Operating income profit/(loss)

5,328

(938)

(66,356)

2,000

5,896

3,436

6,557

Total other gain/(loss)

(3,577)

(2,285)

(2,221)

(4,152)

(3,196)

(2,307)

(2,329)

Profit/(loss) before income taxes

1,751

(3,223)

(68,577)

(2,152)

2,700

1,129

4,228

Income tax benefit/(expense)

(977)

1,371

23,134

663

(1,031)

(324)

(1,907)

Net income/(loss)

774

$

(1,852)

$

(45,443)

$

(1,489)

$

1,669

$

805

$

2,321

$

EBITDA

11,199

$

7,745

$

(57,336)

$

9,590

$

14,230

$

9,747

$

11,054

$

EBITDA (ex. Impairment charges)

11,199

$

7,745

$

10,256

$

9,590

$

14,230

$

9,747

$

11,054

$

Adjusted EBITDA

N/A

N/A

10,256

$

13,126

$

15,954

$

11,271

$

11,471

$ |

Detailed

Historical BS (000's)

12/31/09

12/31/10

12/31/11

12/31/12

12/31/13

6/30/14

9/30/14

ASSETS

Current Assets:

Cash and cash equivalents

7,750

$

5,014

$

799

$

2,326

$

1,138

$

1,041

$

1,902

$

Accounts receivable - total, net of allowance

5,517

6,679

7,448

8,511

10,697

10,768

11,505

Inventory

925

1,699

1,309

1,339

1,234

1,485

1,589

Prepaid expenses and other current assets

395

750

934

684

518

712

621

Deferred income taxes

125

1,147

682

1,971

2,296

2,296

2,296

Total Current Assets

14,712

15,289

11,172

14,831

15,883

16,302

17,913

Total PP&E and Medical Equipment

13,499

16,672

17,672

16,564

18,974

20,017

22,397

Deferred debt issuance costs, net

781

658

421

2,362

1,817

1,505

1,349

Total Goodwill and Intangible assets, net

85,491

97,344

28,221

25,541

24,182

24,287

24,461

Deferred income taxes

0

0

18,187

17,806

16,300

15,376

14,696

Other assets

207

401

590

419

217

248

208

Total Assets

114,690

$

130,364

$

76,263

$

77,523

$

77,373

$

77,735

$

81,024

$

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

Accounts payable - total

1,306

$

2,016

$

4,063

$

2,144

$

4,736

$

4,101

$

4,570

$

Accrued expenses and other

1,573

4,631

2,235

4,098

3,187

2,573

3,303

Derivative liabilities

2,670

183

258

0

0

0

0

Current portion of long-term debt

5,501

5,551

6,576

3,953

5,118

3,871

4,238

Total Current Liabilities

11,050

12,381

13,132

10,195

13,041

10,545

12,111

Long-term debt, net of current portion

18,640

26,646

22,551

27,315

21,609

22,829

23,631

Deferred income taxes

3,314

5,788

0

0

0

0

0

Other liabilities

221

406

415

0

0

0

0

Total Liabilities

33,225

$

45,221

$

36,098

$

37,510

$

34,650

$

33,374

$

35,742

$

Total Stockholders' Equity

81,465

$

85,143

$

40,165

$

40,013

$

42,723

$

44,361

$

45,282

$

Total Liabilities and Equity

114,690

$

130,364

$

76,263

$

77,523

$

77,373

$

77,735

$

81,024

$

Total Debt

24,141

$

32,197

$

29,127

$

31,268

$

26,727

$

26,700

$

27,869

$

Net Debt

16,391

$

27,183

$

28,328

$

28,942

$

25,589

$

25,659

$

25,967

$ |

Comparison to

Other Infusion Companies Stock Comparison

As of 11/20/14

BioScrip

Infu

Stock Price

$ 5.99

2.85

52 Week hi

$ 9.05

4.50

52 Week lo

$ 5.44

1.70

Average Volume

1,000,850

174,194

In $ millions

Market Cap

$411.1m

$63.3m

P/E Ratio

(trailing)

N/A

20.29x

P/E Ratio

(forward)

75.12x

8.82x

Enterprise Value

$821.4m

$89.5m

Revenues (ttm)

$1,030m

$60.8m

Net Income (ttm)

$(93.6)m

$3.18m

EBITDA (ttm)

$(3.5)m

$16.7m

EBITDA Margin (% of rev)

N/A

27.4%

EV / EBITDA

N/A

5.4x

EBITDA Anlayst (FY2014)

$55.0m

17.4

EV / EBITDA

14.9x

5.1x

Stock Comparison

Source: Yahoo Finance

•

INFU has no direct small DME

niche public company comp.

•

One often mentioned is

BioScrip Inc. (BIOS), but like

most other potential comps it is

broadly diversified beyond the

infusion sector. |