Exhibit 10.30

LEASE AGREEMENT

On this 13th day of September 2012, the Landlord-Lessor, RESEARCH PARK DEVELOPMENT CO, LLC, a Michigan Limited Liability Company (“Landlord”), whose address is 1000 E. Mandoline, Madison Heights, MI 48071 and the Tenant-Lessee, INFUSYSTEM, INC., a California Corporation (“Tenant”), whose local address is 31700 Research Park Drive, Madison Heights, MI 48071, enter into this Lease Agreement (“Lease”), subject to the following terms and conditions:

| 1. | Description of the Premises. Landlord leases to Tenant the Premises, legally described in Exhibit A. The Premises includes, approximately 23,980 square feet of office/ warehouse space, and the land upon which it is located, commonly known as 31700 Research Park Drive, Madison Heights, Michigan 48071 (the building and the land are collectively referred to as the “Premises”). |

| 2. | Common Areas. Tenant is the sole occupant of the Premises. |

| 3. | Term. The term of this Lease shall be for a period of 81 months, commencing on January 1, 2013 and concluding on September 30, 2019. |

| 4. | Minimum Rent. Tenant shall pay Landlord rent according to the following schedule: |

| MONTHS |

RENT/MONTH | TOTAL | ||||||

| 01-03@ $00.00 PSF/Gross |

$ | 00,000.00 p/mo | $ | 000,000.00 | ||||

| 04-15@ $11.00 PSF/Gross |

$ | 21,981.67 p/mo | $ | 263,780.04 | ||||

| 16-27@ $11.35 PSF/Gross |

$ | 22,681.08 p/mo | $ | 272,172.96 | ||||

| 28-30@ $00.00 PSF/Gross |

$ | 00,000.00 p/mo | $ | 000,000.00 | ||||

| 31-42@ $11.70 PSF/Gross |

$ | 23,380.50 p/mo | $ | 280,566,00 | ||||

| 43-54@ $12.05 PSF/Gross |

$ | 24,079.92 p/mo | $ | 288,959.04 | ||||

| 55-57@ $00.00 PSF/Gross |

$ | 00,000.00 p/mo | $ | 000,000.00 | ||||

| 58-69@ $12.40 PSF/Gross |

$ | 24,779.33 p/mo | $ | 297,351.96 | ||||

| 70-81@ $12.51 PSF/Gross |

$ | 25,000.00 p/mo | $ | 300,000.00 | ||||

1

The numbered months are listed in Exhibit B.

Rent shall be paid in advance, on the 1st day of each month during the term of the Lease. Tenant shall pay rent to Landlord at the address stated above or at an address designated by Landlord in writing, without any prior demand from Landlord. If Tenant fails to pay any amount due to the Landlord under this Lease within ten (10) days of when the amount is due, Landlord shall assess Tenant a late fee of five (5%) percent of the monthly payment due. As indicated below, Tenant shall be solely responsible for the payment of the utilities, including those months when no rent is due (months: 01-03, 28-30 and 55-57).

| 5. | Additional Rent. See Section 14 below. |

| 6. | Operation and Maintenance of Common Areas. The Premises includes the Landlord’s rights in the general and limited common elements of the Premises. For purposes of this section and wherever else used in this Lease, the common area shall be defined as and include, by way of illustration, but not by way of limitation, all parking areas, landscaped and planting areas, retaining walls, lighting facilities, and all other areas and improvements which may be provided by Landlord to Tenant, their officers, directors, members, employees, agents, attorneys, invitees, licensees, successors and assigns, presently or in the future, so long as Tenant is not in default under the terms of this Lease. Tenant shall have the exclusive right to use the common areas for its intended purposes, subject only to Landlord’s access rights under this lease. |

| 7. | Signs. Tenant already has existing signage. Any changes to the signage shall be in keeping with the character and décor of the Premises and shall be first approved in writing by Landlord, which consent shall not be unreasonably withheld or delayed and shall be in conformity with all federal, state and local statutes and ordinances (“legal requirements”), pertaining to signs. All changes to the signage shall be at Tenant’s sole cost and expense. Upon expiration or termination of the Lease, Tenant shall be entitled to remove its signage and, in such event, shall restore the building’s façade and land to it pre-existing condition. |

| 8. | Use. The Premises are to be used and occupied by Tenant for the operation of general office and medical device distribution, including testing, cleaning, repair, minor fabrication, wholesale pharmacy, and related uses. In the event Tenant desires to change the nature of its business, Tenant shall submit its proposed business change in writing to Landlord for consent, which consent shall not be unreasonably withheld or delayed. No activity shall be conducted on the Premises, which fails to comply with all federal, state and local laws, municipal ordinances or regulations. In addition to all federal, state and local statutes and ordinances, the Premises shall be subject to various use restrictions, including those listed in Section 9 of this Lease. |

2

| 9. | Restrictions. |

| a. | Tenant shall not operate any part of its business on the Premises for other than as set forth in Section 8 above. |

| b. | Any sidewalks, lobbies, passages and stairways shall not be obstructed or used by Tenant for any purpose other than ingress and egress to and from the Premises. |

| c. | The toilet rooms, toilets, urinals, sinks, faucets, plumbing or other service apparatus of any kind shall not be used for any purposes other than those for which they were installed, and no sweepings, rubbish, rags, ashes, chemicals or other refuse or injurious substances shall be place therein or used in connection therewith. |

| d. | Tenant shall not impair in any way the fire safety system and shall comply with all safety, fire protection and evacuation procedures and regulations established by any governmental agency. |

| e. | Tenant shall not hang, install, mount, suspend or attach anything from or to any sprinkler, plumbing, utility or other lines. |

| f. | Tenant shall not change any locks nor place additional locks upon any doors without providing keys or other access acceptable to Landlord. |

| g. | Tenant shall not use nor keep in the Premises any matter having an offensive odor, nor explosive or highly flammable material, nor shall any animals other than handicap assistance dogs in the company of their masters be brought into or kept in or about the Premises. |

| h. | Tenant shall not place weights anywhere beyond the safe carrying capacity of the Premises. |

| i. | The use of rooms as sleeping quarters is strictly prohibited at all times. |

| j. | Tenant shall comply with all parking regulations promulgated by the municipality, including but not limited to the following: Parking shall be limited to automobiles, passenger or equivalent vans, motorcycles, light four wheel pickup trucks and (in designated areas) bicycles. Parked vehicles shall not be used for vending or any other business or other activity while parked in the parking areas. All vehicles entering or parking in the parking areas shall do so at owner’s sole risk and Landlord assumes no responsibility for any damage, destruction, vandalism or theft. Notwithstanding anything to the contrary herein, Tenant and Tenant’s invitees shall be allowed to park large vehicles such as 18-wheel trucks for the purpose of picking up or delivering |

3

| inventory or other items used in Tenant’s business, so long as the same is in accordance with municipal ordinances. Further, Landlord agrees to install lighting and security cameras, on an as needed basis, in the parking lot (the recordings for which shall be solely monitored by Tenant). |

| k. | If smoking is prohibited in or on the Premises by any federal, state or local statutes and ordinances (“legal requirements”), Tenant and its agents shall not smoke on the Premises or at its entrances or exits, except in compliance with law. |

| l. | Except for loading and unloading of inventory or other materials or products used in Tenant’s business, Tenant shall not engage in any manufacturing, production, process, or other business activity in the parking lots, or on any other outside part of the Premises. Tenant shall confine such activities to the interior of the Premises. |

| m. | Landlord reserves the right to rescind, suspend or modify these restrictions, and to make such other rules and regulations as, in Landlord’s reasonable judgment, may from time to time, be needed for the safety, care, maintenance, operation and cleanliness of the Premises. Notice of any action by Landlord, to Tenant, shall have the same force and effect as if originally made a part of this Lease. New restrictions shall not, however, be more restrictive than the restrictions set forth herein or inconsistent with the proper and rightful enjoyment of the Premises by Tenant under the Lease. |

| n. | These restrictions are not intended to give Tenant or its agents any rights or claims in the event that Landlord does not enforce any of the restrictions against Tenant or its agents or if Landlord does not have the right to enforce them and such non-enforcement shall not constitute a waiver as to Tenant or its Agents. |

| 10. | Continuity of Operations. Notwithstanding anything in this Lease to the contrary, if Tenant is not otherwise in default under the lease, and continues to make all payments of Minimum Rent and other charges in accordance with the terms of the lease, Tenant shall not be deemed in breach because of its failure to operate business from the Premises. |

| 11. | Leasehold Improvements: At Landlord’s sole cost and expense, Landlord shall construct Leasehold Improvements to the Premises (“Improvements”) in conformity with the Diagram Scheme and Scope of Work Clarifications, attached hereto and made a part hereof as Exhibit “C.” The Improvements shall be constructed in phases so as to minimize disruption to Tenant’s current business operations; provided, however, said Improvements shall be completed not later than the commencement of the Lease term on January 1, 2013. Further, the Improvements shall be subject to the Representations and Warranties in section 25 below. |

4

| 12. | Abandonment and Vacation of the Premises. If Tenant abandon or vacate the Premises or is dispossessed by process of law or otherwise, any of Tenant’s personal property that is left on the Premises may at the option of Landlord be deemed abandoned after thirty (30) days written notice to Tenant, at Tenant’s last known address. In the event, Tenant does abandon or vacate the Premises or is dispossessed by process of law and the Landlord finds a replacement tenant, Tenant shall be responsible for all moving and storage costs associated with Tenant’s personal property. In no event, shall Landlord be responsible for any damage to Tenant’s personal property remaining on premises. Notwithstanding anything to the contrary herein, in accordance with section 10 above, as long as Tenant is making its payments of Minimum Rent and other charges under the Lease, Landlord shall have no rights under this section 12. |

| 13. | Operations. |

| a. | Subject to section 10, at all times, Tenant shall operate its business in accordance with industry standards. |

| b. | Tenant shall not keep any display windows or signs on the Premises unless approved in writing by Landlord. |

| c. | Tenant shall keep all refuse in the kind of containers in accordance with municipal ordinances. |

| d. | Tenant shall maintain the Premises at a temperature sufficiently high to prevent water from freezing in the pipes or fixtures. |

| 14. | Taxes and Assessments. NONE, EXCEPT AS STATED HEREIN (This is a Gross Lease and includes all maintenance, real estate taxes and property insurance, except as provided for herein. Tenant shall be responsible to pay its utilities (as described below), income taxes, personal property taxes and all other fees and taxes not specifically identified above. |

Notwithstanding the foregoing and subject to the limitations stated herein, Tenant shall pay Landlord, as additional rent, those items set forth below in this Lease and any incremental increases in the Operational Expenses (as defined herein) of Landlord to the extent such Operational Expenses exceed in any calendar year the amount of Operational Expenses paid by Landlord during the 2013 calendar year (the “Base Year”) on a non-cumulative basis. By way of illustration, but not by way of limitation, the phrase “non- cumulative” means the following: Assuming that in 2013, the Operational Expenses (“OE”) equal $50,000. In 2014, the OE equals $52,000. In 2015, the OE equals $55,000. In 2016, the OE equals $54,000. Due to a reduction in the real estate taxes, the OE in 2016 equals $48,000. In the foregoing scenarios, in 2014, Tenant would pay Landlord $2,000; in 2015, Tenant would pay Landlord $5,000; in 2016, Tenant would pay Landlord $4,000.00. In 2016, Tenant would pay Landlord zero because in no event shall Tenant’s obligation for OE be less than zero. Tenant’s share of the annual incremental

5

increases in the Operational Expenses for each calendar year and partial calendar year during the term of this Lease, as the same may be extended hereunder, shall be paid in monthly installments on or before the first (1st) day of each calendar month, in advance, in an amount estimated by Landlord. In the event there is a deficiency in the total amount paid by Tenant and the actual amount due, Tenant shall pay to Landlord the difference between the amount paid by Tenant and the actual amount due within forty-five (45) days after the receipt of a billing statement provided by Landlord. The billing statement shall become a final, binding and non disputable obligation of Tenant and Tenant shall waive any and all rights to dispute the same unless Tenant delivers written notice of all disputed charges to Landlord within thirty (30) days of the date Tenant has received such billing statement and all expense documentation Tenant has requested. Tenant shall be entitled to review any and all expense documentation supporting any charges under this Section.

For purposes of this Lease, “Operational Expenses shall mean costs and expenses, if any, of every kind and nature reasonably paid or incurred by Landlord in operating, equipping, policing and protecting, lighting, heating, cooling, insuring, repairing, replacing and maintaining the Premises, including, without limitation, all common areas, leaseable areas and leased areas, and further including the cost of insuring all property provided by Landlord which may at any time comprise the Premises. Such costs and expenses shall include, but not be limited to illumination, maintenance, installing, renting of Premises signs, cleaning, lighting, snow removal, line painting, parking lot sealing, re-sealing and/or repaving and landscaping, gardening, planting, premiums for liability and property insurance, Landlord’s personal property taxes, real property taxes, janitorial services, supplies, holiday decorations, costs of installation, and maintenance and replacement of equipment used solely at the Premises, air conditioning, heating and ventilation systems, water systems and utilities associated therewith used to provide such services to Tenant, costs incurred in installing, maintaining energy saving utility equipment for the Premises, if any. The term “common areas” shall mean, the parking lot, roadways, pedestrian sidewalks, truckwells, loading docks, delivery areas, landscaped areas, roof areas over the entire Premises and structural outer walls and floors, flashings, gutters and downspouts, if any, and all other areas or improvements which may be provided by Landlord to the Premises. Notwithstanding anything herein to the contrary, Tenant shall not be responsible for any expense or cost which would be deemed a capital improvement or capital expenditure under generally accepted accounting principles.

However, any incremental increases in the Operational Expenses shall be limited to an annual cap equivalent to the increase in the Consumer Price Index (“CPI”). The CPI shall mean the U.S. Department of Labor, Bureau of Labor Statistics, Cost of Living for Urban Consumers in the City of Detroit. If the publication of such index shall have been discontinued, Landlord and Tenant shall accept statistics on the Cost of Living for the Greater Metropolitan Detroit Area as they shall be computed and published by an

6

agency of the United States or by a reasonable financial periodical of recognized authority. In the event, the adjustment can not be computed because of the non-availability of the aforementioned index, or an alternative source, or for any other reason, the monthly rent shall be increased in the same proportion as the decrease in the purchasing power of the U.S. Dollar, if any, at the consumer level. Tenant shall have the right to contest real estate taxes on the Premises and if Tenant so requests, Landlord agrees to consult and cooperate with Tenant and join in such documents as may be necessary and appropriate to the action, but all at non out-of-pocket cost or expense to Landlord.

| 15. | Maintenance and Repairs. Paid by Landlord. (Includes HVAC, plumbing, structural issues, electrical, roof, general maintenance [including snow removal and lawn care], five (5) days of janitorial service each week, window cleaning, fire extinguisher certification, roof, and parking lot, unless said damage is due solely to the negligence or intentional acts of Tenant, its agents, employees and/or customers). Notwithstanding the foregoing, the Liebert HVAC Unit for the Computer Room shall remain the responsibility of Tenant. Tenant acknowledges that complete removal of snow and ice, from the parking lot and the sidewalks, during winter months, is impossible; and, therefore, each party agrees to maintain liability insurance on the Premises and further agrees to indemnify each other as a result of casualties resulting therefrom. |

| 16. | Assignments and Subleases. Tenant agrees not to assign or sublease any part of the Premises without written consent from Landlord, which consent shall not be unreasonably withheld or delayed. Notwithstanding any such assignment or sublease, Tenant remains fully liable under this Lease. Landlord’s right to assign this lease or mortgage the Premise is unqualified. Notwithstanding the provisions of this section, without Landlord’s consent (but upon notification to Landlord as described below), Tenant may assign this Lease to an affiliate of Tenant or to any corporation or other entity with which Tenant may merge or consolidate, or to which all or substantially all of Tenant’s assets are sold, including, specifically, a merger, consolidation or asset transfer; so long as the assignee’s proposed use does not violate the terms of this Lease and assignee’s net worth is equal to or greater than the net worth of Guarantor. Further, Tenant shall give Landlord reasonable notice of the transaction and copies of documentation upon which the transaction is based. On any transfer of the Premises in which the transferee assumes all of Landlord’s obligations under this Lease, Landlord shall be freed from all its obligations under this Lease and from liability for any acts or omissions occurring after the conveyance. Tenant agrees to attorn to any such transferee and to sign and deliver, at Landlord’s request, any documents and letters to assist in that transfer; provided, however, such transferee shall recognize, in writing, Tenant’s rights under the Lease and shall not disturb Tenant’s tenancy so long as Tenant is not in default thereunder. |

7

| 17. | Utilities. Tenant shall have all utilities for the Premises metered in Tenant’s name and shall pay all charges and deposits for utilities for the Premises during the term of the Lease. Further, Landlord shall not be liable for damages from the interruption of utilities because of any casualties or labor disputes, necessary repairs or improvements, or any other causes beyond the Landlord’s reasonable control. |

| 18. | Mutual Releases. None, except as provided for herein. |

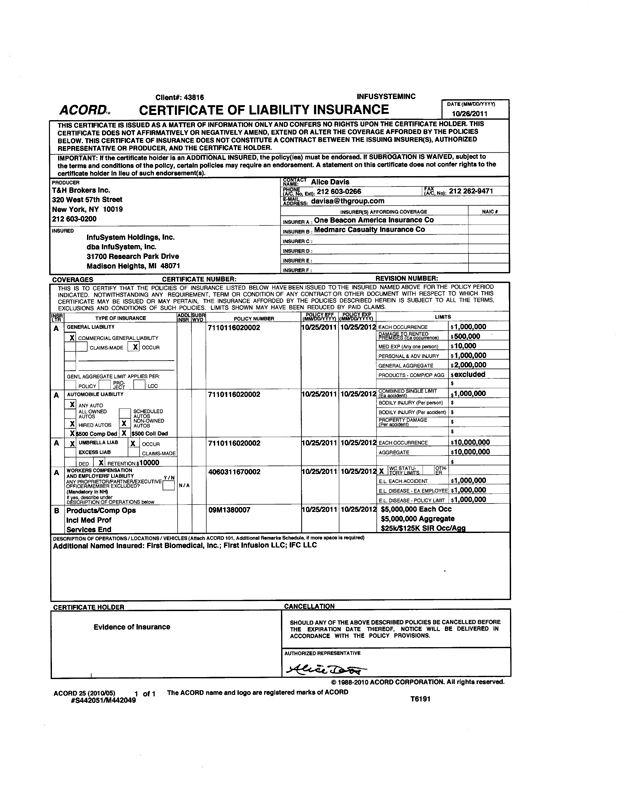

| 19. | Liability Insurance. Tenant shall obtain and maintain in full force and effect commercial general liability insurance, along with the other types of insurance, including the umbrella liability coverage, in the amounts specified in the certificate of insurance attached hereto and made a part hereof as Exhibit F and shall name Landlord as an additional insured party thereon. |

The issuing company of the insurance shall be subject to Landlord’s approval, which approval shall not be unreasonably withheld or delayed. Each insurance policy shall also contain a provision exempting the Landlord from any loss of coverage as an insured due to the acts of Tenant. Tenant shall give Landlord customary insurance certifications evidencing that the insurance is in effect during the term of the Lease. All policies must also provide for notice by the insurance company to Landlord of any termination, cancellation or modification of a policy at least 30 days in advance. All policies shall name both Tenant and Landlord as insured parties. In the event that the insurance policy contains a deductible clause, Tenant hereby indemnifies Landlord against any loss occasioned by the enforcement of the deductible provision of the insurance policy.

All of Tenant’s personal property, including trade fixtures, on the Premises shall be kept at the Tenant’s sole risk, and Landlord shall not be responsible for any loss of business or other loss or damage that is occasioned by acts of God or acts or omissions of persons occupying neighboring premises or any part of the premises adjacent to or connected with the Premises.

Notwithstanding anything herein to the contrary, but subject to the Waiver of Subrogation Provision in section 29 below, if applicable, each party shall be liable to the other for its negligence, intentional acts or breach of this Lease as well as the negligence and intentional acts of its agents, employees and/or representatives.

Landlord shall also maintain Public Liability and Property Insurance as well as Commercial Property Insurance. The Commercial Property Insurance shall be in an amount equal to the replacement cost of the building.

| 20. | Damage and Destruction. If, during the term of this Lease, the Premises are partially or totally destroyed by a casualty covered by insurance and become partially or totally unleaseable, Landlord shall repair the Premises at its expense as soon as possible unless the Lease is terminated, as described herein. If the Premises cannot be repaired within 90 days of the date of |

8

damage, either party may terminate this Lease. If the Premises are damaged and the Lease is not terminated, rent due under the Lease shall abate on a pro-rata basis while the Premises are being restored.

If, during the term of this lease, the Premises are partially or totally destroyed by any casualty and the cost of restoring the Premises to their prior condition is 30% percent or more of their fair replacement value immediately before the damage or if the Premises are damaged by some casualty against which the Landlord has not insured the Premises, the Landlord may terminate this Lease by giving the Tenant written notice within 15 days after the date on which the damage occurs. Such notice shall terminate the Lease from the date when the damage occurred. If the Landlord does not give such notice, the Lease shall continue and the Landlord shall cause the Premises to be repaired as soon as possible.

| 21. | Condemnation. If any public authority takes all or part of the Premises under the power of eminent domain, the term of this Lease shall cease on the part of the Premises to be taken on the day the public authority acquires possession and Tenant shall pay rent up to that date. If a partial taking substantially impairs the use of the Premises for which they were leased, Tenant may either terminate the Lease or continue in possession of the remaining Premises under the provisions of this Lease except that rent shall be reduced in proportion to the amount of the Premises taken. If the Lease is not terminated, Landlord shall restore the remaining Premises to a reasonably leaseable condition. All damages awarded for the taking shall belong to Landlord. Tenant retains the right to recover any and all damages against the public authority as they pertain to its property, its relocation expenses, and its leasehold interests and reimbursement for Tenant’s leasehold improvements. |

| 22. | Alterations. Tenant shall not alter the Premises without prior written consent from Landlord, which shall not be unreasonably withheld or delayed. Cosmetic changes to the building, such as painting, window coverings and the like shall not required Landlord’s consent. Additionally, Tenant shall not be required to obtain Landlord’s consent for any alteration, addition or improvement for which the total cost is $15,000 or less, and which is non- structural in nature; provided, however, said alteration, addition or improvement shall be subject to reasonable notification by Tenant to Landlord, along with any documentation relative to same. All alterations except moveable equipment and trade fixtures that are put in at the Tenant’s expense shall be the property of Landlord and shall remain on the Premises when the Lease terminates. Tenant shall not be responsible for any pre- existing conditions on the Premises, except that Tenant is already in possession of the Premises and accepts the Premise in an “AS IS” condition subject to Landlord’s work set forth in section 11. Landlord may make any changes or alterations to the building, parking lot, driveways, signs, landscaping, sidewalks or other common areas, as it deems necessary, so long as there is no disruption to the ability of Tenant to conduct business as usual on the Premises and provided such changes or alterations do not adversely effect ingress, egress, visibility or parking for or to the Premises. |

9

| 23. | Defaults and Remedies. If the Tenant defaults on any payments to the Landlord and does not cure the default within 10 days of written notice from Landlord, if the Tenant defaults on any other obligations under the Lease and does not cure the default within 30 days after written notice from the Landlord specifying the default, or if the Tenant is adjudicated bankrupt or makes an assignment for the benefit of creditors, then the Landlord may accelerate the balance of rent for the remainder of the terms and sue for the sum due, subject to Landlord’s duty to act reasonably to mitigate its damages hereunder, and may terminate the Lease; alternatively, the Landlord may, without terminating the Lease and after receipt of a valid court order, enter the Premises, dispossess the Tenant and any other occupants of the Premises, remove their effects, and release the Premises under any terms satisfactory to the Landlord. In the event that the default cannot be cured within the specified time, but Tenant timely undertakes to cure same, the time period to cure may be extended for an additional 60 days, but not to exceed a total time of 90 days from the date of notice. If the Landlord chooses the latter option, the Landlord shall credit the proceeds from releasing the Premises, and the Tenant shall remain liable to the Landlord for the balance owed. |

If Landlord defaults in the performance of any obligation hereunder and fails to cure same within 10 days of written notice from Tenant, or immediately in the event of an emergency, then the Tenant may seek a remedy at law or otherwise. Specifically, Tenant may, but shall not be required to, undertake to do anything required to done by the Landlord at Landlord’s cost and expense. In the event that the default cannot be cured within the specified time, but Landlord timely undertakes to cure same, the time period to cure may be extended for an additional 60 days. If a party hereto brings suit to recover possession of the Premises or money due under the Lease or suit for the breach of an obligation that the other party should have performed under the Lease and prevails, the non-prevailing party shall reimburse the prevailing party for expenses incurred in the action, including reasonable attorney fees. In the event, Tenant does abandon or vacate the Premises, Landlord may resort to legal process to evict Tenant and sue to recover damages subject to Landlord’s effort to use reasonable efforts to mitigate its damages, it being understood that Tenant’s failure to operate the business from the Premises shall not be construed to an abandonment or vacation of the premises provided Tenant continues to pay Minimum Rent and other charges under the Lease. Landlord agrees to use its best efforts to mitigate its changes.

| 24. | Personal Guarantee. To induce Landlord to execute this Lease, INFUSYSTEM HOLDINGS, INC., a corporation organized under the Laws of the State of Delaware (“Guarantor”) shall deliver to Landlord its guaranty of Tenant’s obligations under this Lease in the form of Exhibit D attached hereto. If Guarantor fails to deliver such guaranty to Landlord, |

10

| simultaneously with delivery of this Lease to Landlord as executed by Tenant, Landlord shall have no obligation to enter into this Lease and Tenant shall have no rights or interests in the Premises or under this Lease. Within ten (10) days after any request therefore by Landlord, said Guarantor shall execute and deliver to Landlord or to any proposed Purchaser or Lender a written statement certifying that the Guaranty is unmodified and in full force and effect, together with a copy of Guarantor’s most recent financial statements, if not already available online, or other reasonable financial information. In the event Guarantor refuses or fails to execute or deliver such a statement and/or financial statements or information, such refusal or failure shall constitute a default by Tenant under this Lease. If the Options to Renew the Lease are exercised, as provided for in Section 37 below, the Personal Guarantee shall remain in full force and effect. |

| 25. | Representations And Warranties. NONE, except Landlord warrants that all of its work set forth in section 11 shall be done in accordance with all local laws and building codes; shall utilize new, good quality construction materials; shall be undertaken and completed in a good and worker-like manner; and shall be guaranteed to be free from defect of labor and parts for a period of two (2) years (or such longer period as otherwise stated in the Lease) after the work has been completed. In addition, Landlord shall also assign to Tenant any rights that it has to any contractors’ or manufacturers’ warranties on building systems and components. Landlord agrees to complete its work set forth in section 11 above. Substantial completion requires that all municipal inspection of Landlord’s work have occurred and have resulted in satisfactory reports. If the parties cannot agree that Landlord has completed its work, the parties agree to submit the matter to a mutually acceptable arbitrator whose decision shall be binding upon the parties and the cost of which be equally borne by the parties. Landlord shall supply signed unconditional waivers of lien and sworn statements to Tenant indicating that all laborers and material men have been paid in full at the time of completion; provided, however, Landlord shall have no responsibility to Tenant under the foregoing warranty unless Tenant shall furnish to Landlord written notice of the alleged defect and such written notice is received by Landlord before the expiration of the two (2) year warranty period; and Landlord shall have no responsibility to Tenant, or any third Party, for any damage caused by or through the negligence or intentional acts of Tenant, or any of its officers, directors, members, employees, agents, attorneys, invitees, licensees, successors and assigns, Except as otherwise provided herein, Landlord makes no other warranties or representations and all implied warranties are hereby disclaimed. Upon reasonable notice to Landlord, Tenant shall have the right to inspect the Premises prior to, during and/or after the construction of the leasehold improvements. Further, Tenant acknowledges that it has been in possession and occupation of the Premises prior to the commencement date of this Lease, and, except as otherwise provided for in regard to the leasehold improvements, accepts the Premises in an “AS IS” condition. |

11

| 26. | Indemnification for Environmental Conditions. Tenant shall at all times keep the Premises, including but not limited to the building, the land, the ground water and the air of the Property, and their surroundings, free of “hazardous substances,” “hazardous materials,” or equivalent, as defined by any and all present and future federal, state and local laws, ordinances, regulations, permits, guidance documents, policies, and any other requirement of governmental authorities relating to the health, safety, the environment or as to any hazardous substances or materials (collectively described “as defined by law” or “in compliance with the law”). Tenant shall not use, generate, manufacture, store, release, threaten to release or dispose of hazardous substances, hazardous materials, or equivalent, in, on or about the Premises, the building, the land, the ground water and the air of the property, or their surroundings; provided, however, Tenant may use and store on the Premises such types of materials and substances in such typical amounts as are reasonably and customarily used, stored or produced in the Tenant’s industry provided that such use, storage or production is in compliance with the law. In no event shall Tenant dispose of, or permit the disposal of hazardous substances, materials, or equivalent, in any manner other than the manner permitted as defined by law and in compliance with the law. |

Within ten (10) days of the execution of this Lease, Landlord shall provide to Tenant a recently completed Phase I Environmental Audit performed by Applied Science and Technology (“ASTI”). This Audit was completed at the time the property was purchased by Landlord (“Phase I Audit”). Likewise, at the conclusion of Tenant’s tenancy, Landlord shall conduct, at its own cost and expense another Phase I Environmental Audit. This Audit shall be also conducted by ASTI or an environmental service group as may be reasonably acceptable to Landlord and Tenant. Within thirty (30) days from the conclusion of Tenant’s tenancy, the environmental testing group shall submit its report to Landlord and Tenant. In the event that the Premises, including the building, the land, the ground water and the air of the Premises, and their surroundings, are not free from hazardous materials, as hereinbefore defined, and in the event that the hazardous materials was either caused by, or arose out of, or resulted from, or occurred in connection with, or grew out of, or was in any way related to Tenant’s occupancy or use of the Premises, (regardless of when such circumstances are first discovered and regardless of whether or not such circumstances were actually known by Tenant),

Tenant agrees that it will indemnify, defend and hold harmless Landlord, its officers, directors, members, employees, agents, attorneys, invitees, licensees, successors and assigns, against all obligations and liabilities (“Damages”) arising out of claims made or actions brought as a result of hazardous substances, hazardous materials, or equivalent, as defined by law, in, on or about the Premises, the building, the land, the ground water and the air of the Property, or their surroundings. “Damages” under this Agreement shall include any and all injury or loss either to person (bodily injury or wrongful death), property (real or personal) on the Premises, the building, the land upon which it is located, the ground water of the Property, the air of the

12

Property, or surroundings, expenses of remediation, claims by third parties for indemnification or contribution for their remedial expenses, contract rights, enforcement actions, fines, penalties, consent decrees, administrative or court orders or settlements.

| a. | Indemnification does not apply to any such obligations and liabilities arising from the independent negligent acts or omissions or willful misconduct of Landlord. |

| b. | Tenant is required to promptly notify Landlord if and when 1) any release occurs, 2) any hazardous substances, hazardous materials, or equivalent, are discovered, and/or 3) any notice is received from a public agency concerning environmental issues that may trigger indemnification under this Agreement. |

| 27. | Financial Statements. Tenant is a publicly traded company on the AMEX; and, as such, Tenant’s Financial Statements are currently available to Landlord online. However, if Tenant’s publicly traded status changes or if Tenant’s Financial Statements are no longer available to Landlord online, Tenant shall, upon request, but no more than once per calendar year, provide Landlord and/or Landlord’s mortgagee with a copy of same. Landlord agrees to keep all nonpublic information and documentation submitted by Tenant under this Lease in strictest confidence. This information will only be shared with Landlord’s accountants, attorneys, and Landlord’s lender. |

| 28. | Access to Premises. Landlord may enter the Premises during normal business hours after prior notice unless in the event of an emergency, wherein Landlord may enter the Premises at anytime. In the event of a substantial repair, Tenant may elect to have said repair made after normal business hours. The Landlord may use any part of the Premises to install, maintain, use, repair, or replace any mechanical equipment serving the Premises. |

| 29. | Waiver of Subrogation. Landlord and Tenant hereby waive any and all rights of recovery against the other, or against the members, officers, employees, agents, representatives, successors and assigns of the other party for loss or damage to its property or the property of others under its control if such loss or damage is covered by any insurance policy in force (whether or not described in this Leas) at the time of such loss or damage; unless the injury or damage shall have been caused by the gross negligence, willful misconduct or intentional acts of the other party and/or if the insurance policy in force is not sufficient to cover the loss or damage. |

| 30. | Waiver. Any failure of the Landlord or Tenant to insist on strict performance of any provisions of this Lease shall not be deemed a waiver of the provisions of the Lease in any subsequent default. This Lease may not be changed, modified, or discharged except in writing signed by both parties. |

13

| 31. | Notices. All notices under this Lease shall be in writing and shall be deemed given when they are either delivered personally or mailed by certified or registered mail to the receiving party at the address stated below or at an address furnished to the other party in writing during the term of this Lease. |

TO TENANT:

Infusystem, Inc.

Att: Jonathan P. Foster, CFO

31700 Research Park Drive

Madison Heights, MI 48071

TO LANDLORD:

Research Park Development Co, LLC

Att: Edward Sherman, Bill Kemp & Paul S. Hoge

1000 E. Mandoline

Madison Heights, Michigan 48071

| 32. | Quiet enjoyment. Landlord covenants that as long as Tenant pays the rent on a timely basis and when due and complies with the other provisions of this Lease, Landlord shall not disturb Tenant’s tenancy and Tenant may quietly enjoy the Premises for the full term of this lease. |

| 33. | Subordination to mortgages. Tenant subordinates all its interests in the leasehold to the liens of any mortgages now or later placed on any property of which the Premises are a part. At Landlord’s request, Tenant shall sign any and all documents necessary to effectuate this subordination. Notwithstanding this subordination, Tenant’s possession of the Premises shall not be disturbed by any mortgagee or holder of a note secured by a mortgage now or later placed on the Premises unless Tenant defaults on a provision of the Lease and Tenant’s possession is lawfully terminated in accordance with the provisions of the Lease. If Landlord requests Tenant to execute an estoppel letter, non-disturbance agreement, or similar certificate or agreement, Tenant shall not be obligated to execute and deliver such document(s) more than once in any six (6) month period unless Landlord pays the attorney fees incurred by Tenant in responding to such request. |

| 34. | Security deposit. $18,100.00, transferred from existing lease. Except as provided for herein, Landlord shall hold the Security Deposit, without liability for interest, as security for the Tenant’s faithful performance of all the terms, covenants, and conditions of this Lease. If Tenant fails to keep and perform any of the terms, covenants and conditions of this Lease, then Landlord, at its option, may appropriate and apply the entire Security Deposit, or as much as may be necessary, to compensate Landlord for losses or damages it sustains due to Tenant’s breach. If the entire Security Deposit, or any portion thereof, is appropriated and applied by Landlord to pay overdue rent or other sums due and payable to Landlord by Tenant under this Lease, then Tenant shall, upon the written demand of Landlord, immediately remit to Landlord a |

14

| sufficient amount in cash to restore the Security Deposit to the original sum deposited. Tenant’s failure to do so within five (5) days from receipt of said written demand shall constitute breach of the Lease. If Tenant has complied with all of the terms, covenants and conditions of this Lease, Tenant shall vacate the Premises after the Lease term, and return the Premises to Landlord in the same condition as received, normal wear and tear excluded. In such event, Landlord shall return the Security Deposit to Tenant within a reasonable period of time, not to exceed 60 days from the end of the Lease. Further, Landlord shall not be obligated to keep the Security Deposit in a separate fund, but may mix the said Security Deposit with its own funds. |

Notwithstanding the foregoing, upon successful completion of the thirty-sixth (36th ) month of the Lease, upon notice from Tenant, Landlord shall, within thirty (30) days thereof, return the Security Deposit to Tenant; provided, however, nothing herein nullifies Tenant’s obligation to vacate the Premises after the Lease term, and return the Premises to Landlord in the same condition as received, normal wear and tear excluded.

| 35. | Surrender of Premises. Upon termination of this Lease, Tenant shall surrender the Premises in a substantially similar condition as existed on the commencement date of the Lease, excepting reasonable wear and tear; damage by the elements, fire and other casualty, alterations or additions permitted under this Lease and acts of abutting property owners and person over whom Tenant has no control. |

| 36. | Holding over. If Tenant remains in possession of the Premises after the Lease expires or the Lease is terminated, Tenant shall be deemed to occupy the Premises on a month-to-month basis and be subject to all the terms of this Lease as they may apply to a month-to-month tenancy, with rent at an amount equal to 120% of the last month’s rent under this Lease. Either party may cancel such a tenancy on 30 days written notice to the other party. |

| 37. | Options to Renew. Tenant is hereby granted two (2) five (5) year Options to Renew the Lease (the “First Option” and “Second Option,” respectively). The First Option and Second Option shall be subject to the provisions herein and subject to the “Fair Market Rent Exhibit” (Exhibit E). |

For the First Option, the term shall commence on October 1, 2019 and shall continue until September 30, 2024 (the “First Option term”). During the First Option term, Tenant shall pay Landlord rent in accordance with Exhibit E; provided, however, under no circumstances shall the rent be less than the rent paid during the last year of the Lease (months 70 to 81). Tenant shall notify Landlord of its intent to exercise the First Option, in writing, by certified mail, return receipt requested, at least one hundred eighty (180) days (by April 1, 2019) prior to the end of the 81st month of the Lease; otherwise, said First Option shall be null and void. In addition, the First Option shall not be exercisable if Tenant has an existing uncured default and is not then in compliance with the provisions of Exhibit E. Further, exercise of the First Option and completion of the First Option term is a condition precedent to the

15

exercise of the Second Option. Except as modified herein, all of the same terms and conditions contained in this Lease shall be applicable during the First Option term.

For the Second Option, the term shall commence on October 1, 2024 and shall continue until September 30, 2029. During the Second Option term, Tenant shall pay Landlord rent in accordance with Exhibit E; provided, however, under no circumstances shall the rent be less than the rent paid during the First Option term (months 130 to 141). Tenant shall notify Landlord of its intent to exercise the Second Option, in writing, by certified mail, return receipt requested, at least one hundred eighty (180) days (by April 1, 2024) prior to the end of the 141st month of the Lease; otherwise, said Second Option shall be null and void. In addition, the Second Option shall not be exercisable if Tenant has an existing uncured default and is not then in compliance with the provisions of Exhibit E. Except as modified herein, all of the same terms and conditions contained in this Lease shall be applicable during the Second Option term.

During the Options terms, Tenant shall continue to comply with all of the provisions herein, including Section 14 above regarding Tenant’s payment of the increase in the Operational Expenses with a Base Year of 2013.

| 38. | Option to Cancel Lease: Tenant is hereby granted one (1) Option to Cancel the Lease (the “Option to Cancel”), on the terms and conditions stated herein. Only months 70 through 81 are subject to cancellation. In order to exercise the Option to Cancel, Tenant shall notify Landlord, in writing (the “Notice”), and shall deliver said Notice to Landlord, by either personal service or by certified mail, return receipt requested, at Landlord’s address set forth above, or at any subsequent address that Landlord provides in writing to Tenant. Said Notice shall be delivered, by the methods described above, not later than April 1, 2018 [which is six (6) months prior to the expiration of the 69th month, being September 30, 2017; otherwise, said Option shall be null and void. The Notice shall be signed by Tenant and shall restate in the body of the Notice that the Lease is hereby cancelled as of October 1, 2018. Notwithstanding the foregoing, the Option to Cancel shall not be exercisable if Tenant has an existing uncured default, or after termination of the Lease, or after abandonment or surrender of the Premises by Tenant and the remaining twelve (12) months of the Lease term shall continue as provided for herein. Further, the Option to Cancel is not assignable and may only be exercised by Tenant (including a successor corporation or other entity due to a merger or acquisition of Tenant by such successor) and by no other person or entity. If Tenant properly exercises the Option to Cancel, as described above, Tenant shall continue to pay the monthly rent, from April 1, 2018 through September 30, 2018, as specified in Section 2 above and shall otherwise comply with all terms and conditions of the Lease. In addition, Tenant shall pay a cancellation penalty to Landlord equal to all unamortized tenant improvements, free rent, and leasing commissions, which penalty shall be payable upon notice of termination (April 1, 2018) in the total amount of Two Hundred Thousand and 00/100 ($200,000.00) Dollars. |

16

| If Tenant properly exercises the Option to Cancel, as described above, and pays the cancellation penalty, the remaining twelve (12) months of the Lease shall be cancelled. In such an event, Tenant agrees that Landlord may show the Premises to prospective Tenants and may display in and about the Premises the usual and customary “TO RENT” or “TO LEASE” signs. |

| 39. | Recording. Tenant shall not record this Lease without written consent from Landlord. However, on the request of either party, the other shall join in signing a Memorandum of this Lease to be recorded. The Memorandum shall describe the parties, the Premises, and the provisions of the Lease and shall incorporate the Lease by reference. It shall be accompanied by a Discharge of the Memorandum of Lease, which Discharge shall be held in escrow pending the conclusion of Tenant’s occupancy. |

| 40. | Captions and Headings. The captions and headings used in this Lease are intended only for convenience and are not to be used in construing the lease. |

| 41. | Applicable Law. The substantive laws of the State of Michigan shall govern the validity, construction, enforcement and interpretation of this Lease. Further, if any provision of this Lease is unenforceable, the other provisions of the Lease shall remain valid and enforceable to the fullest extent permitted by law. |

| 42. | Successors. The provisions of this Lease shall benefit and bind Landlord, Landlord’s agents, successors and assigns and Tenant, Tenant’s agents, successors and permitted assigns. |

| 43. | Prohibition of Partnerships. The parties disclaim any intentions to enter into a joint venture or a partnership with each other. |

| 44. | Trade Fixtures. All trade fixtures and movable equipment installed by Tenant in connection with its business shall remain the property of Tenant and may be removed when this Lease expires. Tenant shall repair any damage caused by the removal of such fixtures and shall restore the Premises to the condition at the time this Lease is signed. |

| 45. | Mechanics’ Liens. Tenant shall promptly pay for any labor, services, materials, supplies or equipment furnished to Tenant in or about the Premises. Tenant shall keep the Premises, including the building and the land, free from any liens arising out of any labor, services, materials, supplies or equipment furnished or alleged to have been furnished to Tenant. Tenant shall take all steps permitted by law in order to avoid the imposition of any lien. Should any such lien or notice of such lien be filed against the Premises, the building or the land, Tenant shall discharge the same by bonding or otherwise within thirty (30) days after Tenant has notice that the lien or claim is filed regardless of the validity of such lien or claim. |

17

| 46. | Indemnity. Tenant agrees to indemnify and defend Landlord, its agents, officers, directors, members, employees, agents, attorneys, invitees, licensees, successors and assigns, for any liability, loss, damage, cost, or expense (including attorneys fees) based on any claim, demand, suit, or action by any party with respect to any personal injury (including death) or property damages, from any cause, with respect to Tenant or the Premises, except for liability resulting from third parties, from circumstances beyond Tenant’s control and from the intentional or gross negligent acts or omissions of Landlord, its agents, officers, directors, members, employees, agents, attorneys, invitees, licensees, successors and assigns. |

| 47. | Brokerage Commission. Tenant represents and warrants that it has dealt directly with only one Broker, Randall Tarnow, of Mohr Partners, Inc., as Tenant’s Broker in connection with this Lease. Landlord agrees to pay Tenant’s Broker an agreed upon brokerage fee, which fee shall be specified in a side letter executed and signed by Landlord and Tenant’s Broker. Landlord indemnifies, defends and holds Tenant harmless from the brokerage fee due and owing to Tenant’s Broker. Tenant indemnifies, defends and holds Landlord harmless from any and all claims of any other Brokers claiming to have represented Tenant in connection with this Lease. |

| 48. | Broker Disclaimer and Disclosure. This Lease has been prepared by Landlord and Landlord’s attorney for submission to Tenant and Tenant’s attorney for review and approval. No representation or recommendation is made by Landlord, Landlord’s attorney or by Signature Associates, Inc., as to the legal sufficiency, legal effect, or tax consequences of this Lease, or the transaction relating thereto; the parties shall rely solely upon the advice of their own legal counsel as to the legal sufficiency, legal effect and tax consequences of this Lease. Further, Paul S. Hoge discloses that he is an associate broker with Signature Associates and a partial owner/member of the Landlord, Research Park Development Co., LLC. Notwithstanding the foregoing, Signature Associates is not entitled to a brokerage commission on this transaction and Landlord indemnifies Tenant therefrom. |

| 49. | Commencement Date. The commencement date of this Lease shall be determined as provided for in Section 3 above. |

| 50. | Landlord’s Work. None, except as stated in Section 11 above. |

| 51. | Transmission, Counterparts and Authority: The parties acknowledge and agree that this Lease may be signed and forwarded by facsimile or email transmission and such facsimile or email transmission shall have the same binding and legal effect as original signatures. Further, this Addendum may be signed in counterparts, all of which when taken together, shall constitute one full and complete document. Further, by execution of this Addendum, the undersigned represent and warrant to each other that they have authority to act for their respective parties of interest, Landlord and Tenant. |

18

| 52. | Singular; Plural. Whenever herein the singular number is used, the same shall include the plural where appropriate, and words of any gender shall include each other gender where appropriate. |

| 53. | Entire Agreement; Amendments. This Lease represents the final agreement between the parties and may not be contradicted by evidence of prior, contemporaneous or subsequent oral agreements of the parties. There are no unwritten oral agreements between the parties. This Lease cannot be amended except by agreement in writing by the party against whom enforcement of the amendment is sought. |

| 54. | Exhibits. All the forms attached to Lease are incorporated in the Lease and made a part hereof and each party has reviewed and approved the same. |

| 55. | Time. Time shall be deemed of the essence in this Lease. |

| 56. | Other Charges. None. |

IN WITNESS WHEREOF, the Parties have hereunto executed this Lease Agreement on the day and year first above written.

| LANDLORD: |

TENANT: | |||

| Research Park Development Co, LLC | Infusystem, Inc. | |||

| a Michigan Limited Liability co. | a California corporation | |||

| /s/ Edward Sherman |

/s/ Jonathan P. Foster | |||

| By: Edward Sherman, Co-Trustee |

By: Jonathan P. Foster, CPA | |||

| Its: Member |

Its: Chief Financial Officer | |||

| /s/ William T. Kemp |

||||

| By: William T. Kemp, Trustee |

||||

| Its: Member |

||||

| /s/ Paul S. Hoge |

||||

| By: Paul S. Hoge, Trustee |

||||

| Its: Member |

||||

| /s/ Janann A. Hoge |

||||

| By: Janann A. Hoge, Trustee |

||||

| Its: Member |

||||

19

| STATE OF MICHIGAN ) |

||||||||

|

)SS |

||||||||

| COUNTY OF OAKLAND ) |

||||||||

On this 17th day of September 2012, before me a Notary Public in and for said County, appeared Edward Sherman, Co-Trustee, William T. Kemp, Trustee, Paul Hoge, Trustee, Janann A. Hoge, Trustee, all Members of Research Park Development Co, LLC, a Michigan Limited Liability Company, to me personally known, who, being by me sworn, did say that they are Members of the Landlord limited liability company named in the Lease, that they have authority to execute the within instrument on behalf of the LLC, that they executed the within instrument, that said instrument was signed and sealed and constituted their free act and deed on behalf of said Landlord.

| /s/ Barbara J. Newman | ||

| Notary Public | ||

| County, Michigan | ||

| Acting in Oakland County, Michigan | ||

| My Commission Expires: |

November 19, 2014 | |

| STATE OF MICHIGAN ) |

||||||||

|

)SS |

||||||||

| COUNTY OF OAKLAND ) |

||||||||

On this 13th day of September 2012, before me a Notary Public in and for said County, appeared Jonathan P. Foster, CPA, Chief Financial Officer of Infusystem, Inc., a California corporation, to me personally known, who, being by me sworn, did say that he is Chief Financial Officer of the Tenant corporation named in the Lease, that he has authority to execute the within instrument on behalf of the corporation, that he executed the within instrument, that said instrument was signed and sealed and constituted his free act and deed on behalf of said Tenant.

| /s/ Marnie A. Pasmanter | ||

| Notary Public | ||

| County, Michigan | ||

| Acting in Oakland County, Michigan | ||

| My Commission Expires: |

December 14, 2014 | |

20

EXHIBIT A

EXHIBIT “A”

LEGAL DESCRIPTION

Land in the City of Madison Heights, County of Oakland, State of Michigan, described as: Part of Lots 34 through 37 inclusive, of UNIVERSITY PLACE INDUSTRIAL PARK NO. 2 SUBDIVISION of part of the South 1/2 of Section 1, Town 1 North, Range 11 East, City of Madison Heights, Oakland County, Michigan, as recorded in Liber 183, pages 18 through 22 of the Oakland County Records, being more particularly described as beginning at the Southeast corner of Lot 37 and the North line of Tech Row (60 Feet wide) thence South 89 degrees 47 minutes 13 seconds West, along said North line 304.51 feet; thence 47.66 feet along the arc of a curve to the right (Radius equals 30.00 feet, central angle of 91 degrees 01 minutes 16 seconds long chord bears North 44 degrees 42 minutes 09 seconds West 42.80 feet); thence North 00 degrees 48 minutes 29 seconds East, along the East line of Research Park Drive (60 feet wide) 285.68 feet, thence South 89 degrees 11 minutes 31 seconds East, 329.48 feet; thence South 00 degrees 12 minutes 47 seconds East 310.30 feet to the point of beginning.

EXHIBIT B

EXHIBIT “B”

RENT SCHEDULE

| NUMBER |

MONTHS |

YEAR | PSF/GROSS | MONTHLY RENT | ||||

| 01 | January | 2013 | $0 | $0 | ||||

| 02 | February | 2013 | $0 | $0 | ||||

| 03 | March | 2013 | $0 | $0 | ||||

| 04 | April | 2013 | $11.00 | $21,981.67 | ||||

| 05 | May | 2013 | $11.00 | $21,981.67 | ||||

| 06 | June | 2013 | $11.00 | $21,981.67 | ||||

| 07 | July | 2013 | $11.00 | $21,981.67 | ||||

| 08 | August | 2013 | $11.00 | $21,981.67 | ||||

| 09 | September | 2013 | $11.00 | $21,981.67 | ||||

| 10 | October | 2013 | $11.00 | $21,981.67 | ||||

| 11 | November | 2013 | $11.00 | $21,981.67 | ||||

| 12 | December | 2013 | $11.00 | $21,981.67 |

| NUMBER |

MONTHS |

YEAR | PSF/GROSS | MONTHLY RENT | ||||

| 13 | January | 2014 | $11.00 | $21,981.67 | ||||

| 14 | February | 2014 | $11.00 | $21,981.67 | ||||

| 15 | March | 2014 | $11.00 | $21,981.67 | ||||

| 16 | April | 2014 | $11.35 | $22,681.08 | ||||

| 17 | May | 2014 | $11.35 | $22,681.08 | ||||

| 18 | June | 2014 | $11.35 | $22,681.08 | ||||

| 19 | July | 2014 | $11.35 | $22,681.08 | ||||

| 20 | August | 2014 | $11.35 | $22,681.08 | ||||

| 21 | September | 2014 | $11.35 | $22,681.08 | ||||

| 22 | October | 2014 | $11.35 | $22,681.08 | ||||

| 23 | November | 2014 | $11.35 | $22,681.08 | ||||

| 24 | December | 2014 | $11.35 | $22,681.08 |

| NUMBER |

MONTHS |

YEAR | PSF/GROSS | MONTHLY RENT | ||||

| 25 | January | 2015 | $11.35 | $22,681.08 | ||||

| 26 | February | 2015 | $11.35 | $22,681.08 | ||||

| 27 | March | 2015 | $11.35 | $22,681.08 | ||||

| 28 | April | 2015 | $0 | $0 | ||||

| 29 | May | 2015 | $0 | $0 | ||||

| 30 | June | 2015 | $0 | $0 | ||||

| 31 | July | 2015 | $11.70 | $23,380.50 | ||||

| 32 | August | 2015 | $11.70 | $23,380.50 | ||||

| 33 | September | 2015 | $11.70 | $23,380.50 | ||||

| 34 | October | 2015 | $ 11.70 | $ 23,380.50 | ||||

| 35 | November | 2015 | $11.70 | $23,380.50 | ||||

| 36 | December | 2015 | $11.70 | $23,380.50 |

| NUMBER | MONTHS |

YEAR |

PSF/GROSS |

MONTHLY RENT | ||||

| 37 | January | 2016 | $11.70 | $23,380.50 | ||||

| 38 | February | 2016 | $11.70 | $23,380.50 | ||||

| 39 | March | 2016 | $11.70 | $23,380.50 | ||||

| 40 | April | 2016 | $11.70 | $23,380.50 | ||||

| 41 | May | 2016 | $11.70 | $23,380.50 | ||||

| 42 | June | 2016 | $11.70 | $23,380.50 | ||||

| 43 | July | 2016 | $12.05 | $24,079.92 | ||||

| 44 | August | 2016 | $12.05 | $24,079.92 | ||||

| 45 | September | 2016 | $12.05 | $24,079.92 | ||||

| 46 | October | 2016 | $12.05 | $24,079.92 | ||||

| 47 | November | 2016 | $12.05 | $24,079.92 | ||||

| 48 | December | 2016 | $12.05 | $24,079.92 |

| NUMBER |

MONTHS |

YEAR |

PSF/GROSS |

MONTHLY RENT | ||||

| 49 | January | 2017 | $12.05 | $24,079.92 | ||||

| 50 | February | 2017 | $12.05 | $24,079.92 | ||||

| 51 | March | 2017 | $12.05 | $24,079.92 | ||||

| 52 | April | 2017 | $12.05 | $24,079.92 | ||||

| 53 | May | 2017 | $12.05 | $24,079.92 | ||||

| 54 | June | 2017 | $12.05 | $24,079.92 | ||||

| 55 | July | 2017 | $0 | $0 | ||||

| 56 | August | 2017 | $0 | $0 | ||||

| 57 | September | 2017 | $0 | $0 | ||||

| 58 | October | 2017 | $12.40 | $24,779.33 | ||||

| 59 | November | 2017 | $12.40 | $24,779.33 | ||||

| 60 | December | 2017 | $12.40 | $24,779.33 |

| NUMBER |

MONTHS |

YEAR |

PSF/GROSS |

MONTHLY RENT | ||||

| 61 | January | 2018 | $12.40 | $24,779.33 | ||||

| 62 | February | 2018 | $12.40 | $24,779.33 | ||||

| 63 | March | 2018 | $12.40 | $24,779.33 | ||||

| 64 | April | 2018 | $12.40 | $24,779.33 | ||||

| 65 | May | 2018 | $12.40 | $24,779.33 | ||||

| 66 | June | 2018 | $12.40 | $24,779.33 | ||||

| 67 | July | 2018 | $12.40 | $24,779.33 | ||||

| 68 | August | 2018 | $12.40 | $24,779.33 | ||||

| 69 | September | 2018 | $12.40 | $24,779.33 | ||||

| 70 | October | 2018 | $12.51 | $25,000.00 | ||||

| 71 | November | 2018 | $12.51 | $25,000.00 | ||||

| 72 | December | 2018 | $12.51 | $25,000.00 |

| NUMBER |

MONTHS |

YEAR | PSF/GROSS | MONTHLY RENT | ||||

| 73 | January | 2019 | $12.51 | $25,000.00 | ||||

| 74 | February | 2019 | $12.51 | $25,000.00 | ||||

| 75 | March | 2019 | $12.51 | $25,000.00 | ||||

| 76 | April | 2019 | $12.51 | $25,000.00 | ||||

| 77 | May | 2019 | $12.51 | $25,000.00 | ||||

| 78 | June | 2019 | $12.51 | $25,000.00 | ||||

| 79 | July | 2019 | $12.51 | $25,000.00 | ||||

| 80 | August | 2019 | $12.51 | $25,000.00 | ||||

| 81 | September | 2019 | $12.51 | $25,000.00 |

EXHIBIT C

EXHIBIT C, PAGE 2

SCOPE OF WORK CLARIFICATIONS

ATTACHMENT TO LEASE AGREEMENT BETWEEN

KEMP & SHERMAN AND INFUSYSTEM

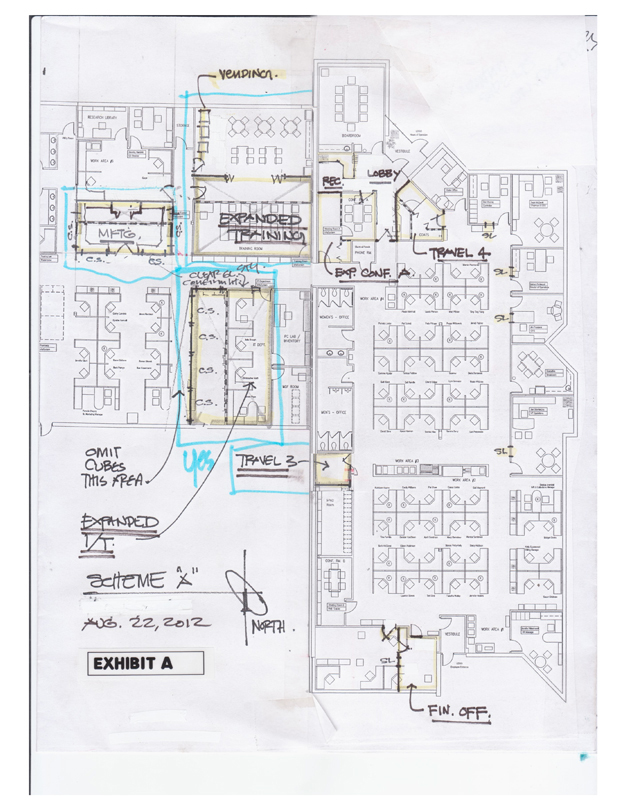

1. Renovate existing space in accordance with Exhibit A – Floor Plan Sketch “Scheme A”; dated August 22, 2012.

2. Work shall be limited, except as noted below, to the areas indicated on the sketch shown on Exhibit A, identified as: MKT’G. (Marketing Area), EXPANDED TRAINING, EXPANDED I/T and TRAVEL 3, TRAVEL 4, EXP CONF. “A”, REC (Reception), LOBBY, FIN. OFF. (Finance Office)

3. Demolish, construct new or alter existing interior partitions, doors, ceilings, electrical, mechanical and plumbing as required to accommodate the Proposed Rooms/Offices/Areas described above and shown on Exhibit A – Floor Plan Sketch “Scheme A”.

4. Add electrical and necessary cabling “drops” for wall mounted flat screens (screens to be provided by tenant) in Exp. Conf. A, CFO, CEO, VP of Ops, Main conference room, and in four other areas to be designated by tenant, which may be outside of the areas noted in 2 above.

5. Existing partitions, doors, ceilings, electrical, mechanical and plumbing items will remain, reused and or modified as required to accommodate the Rooms/Offices/Areas described above and shown on Exhibit A – Floor Plan Sketch “Scheme A”.

6. Re-use/relocate, existing office doors when appropriate or provide new office doors to match existing as close as possible. In addition, a 15’ to 18’ wide folding, “accordion style” door will be provided between the existing Lunch/Break Room and the Proposed Expanded Training Room. A 6 foot wide bi-fold door is included in the Marketing Area.

7. Provide new interior glass side lite at existing offices as indicated by the symbol “SL” as shown.

8. Provide new interior glass clear story lite at existing offices as indicated by the symbol “CS” as shown.

9. Construct new Reception Area Greeters Desk and millwork to be similar to existing to be removed. (Re-use existing components when appropriate.

10. Existing Toilet Rooms – throughout the building shall be rehabilitated as follows:

§ Clean and repaint walls and ceilings (if/where drywall)

§ Thoroughly clean all tile and grout, reseal grout.

§ Clean, repair and or replace broken fixtures, partitions, faucets, etc. as required.

11. Modify existing and/or provide new Acoustical Ceiling grid and pads as required within renovated Rooms/Offices/Areas described above and shown on Exhibit A – Floor Plan Sketch “Scheme A”.

12. All other existing acoustical ceilings shall remain except in all areas any damaged ceiling tiles will be replaced.

13. Paint all new and “affected only” existing interior “walls only”.

14. Work in, or construction within, other areas is excluded.

15. New carpet or VCT with vinyl base will be provided within the New Areas only.

16. Modify existing Fire Protection, Plumbing, HVAC and Electrical System(s) (i.e. piping, sprinkler heads, ductwork, grilles, registers, diffusers, wiring, lights, switches, etc.) as required to accommodate the proposed lay-out.

17. Electrical work shall include the appropriate outlets, switches, lighting, fixtures, exist signs, etc. as what is commonly accepted in a typical commercial Office Space.

18. All other millwork, furniture, fixtures, equipment, other than noted above is all excluded.

19. Carpet – Remove and replace heavily stained or damaged carpet as necessary with material to match existing if/when available. If not available, selectively replace larger areas with the appropriate “accent” carpet, as approved by the tenant.

EXHIBIT D

EXHIBIT “D”

GUARANTY

THIS GUARANTY is made this 13th day of September, 2012, by INFUSYSTEM HOLDINGS, INC., a Delaware corporation (“Guarantor”).

BACKGROUND:

A. RESEARCH PARK DEVELOPMENT CO, LLC, a Michigan limited partnership (“Landlord) with offices at 1000 East Mandoline, Michigan 48071, is about to enter into a certain lease (the “Lease”) with INFUSYSTEM, INC., a California corporation (“Tenant”), for approximately 23,980 rentable square feet of space in Landlord’s building located at 31700 Research Park Drive, Madison Heights, Michigan, as more particularly described in the Lease (the “Premises”).

B. Guarantor is the parent corporation of Tenant and therefore benefits directly from the Lease.

C. Landlord has agreed to grant, execute and deliver the Lease to Tenant in consideration, among other things, of the covenants and obligations made and assumed by Guarantor as herein set forth.

AGREEMENT:

In order to induce Landlord to execute the Lease and in further consideration of the sum of Ten Dollars ($10.00) and other good and valuable consideration paid by Landlord to Guarantor, intending to be legally bound hereby, Guarantor irrevocably and unconditionally agrees as follows:

1. Guarantor hereby guarantees, without the necessity of prior notice, the full and prompt payment of all rent and additional rent and any and all other sums payable by Tenant under the Lease, and the due and punctual performance of all of Tenant’s other obligations thereunder.

2. Guarantor hereby guarantees, without the necessity of prior notice, the due and punctual payment in full of any and all loss, damages or expenses incurred by Landlord and arising out of any default by Tenant in performing any of its obligations under the Lease, including but not limited to, all reasonable and actual attorneys’ fees which Landlord incurs as the result of the default of Tenant or the enforcement of this Guaranty.

3. Landlord may, in its sole discretion, without notice to Guarantor and without in any way affecting or terminating any of Guarantor’s obligations and liabilities hereunder, from time to time, (a) waive compliance with the terms of the Lease or any default thereunder; (b) modify or supplement any of the provisions of the Lease; (c) grant any extension or renewal of the terms of the Lease; (d) effect any release, compromise or settlement in connection therewith; (e) assign or otherwise transfer any or all of Landlord’s interest in the Lease; or (f) accept or discharge any other person as a guarantor of any or all of the Tenant’s obligations under the provisions of the Lease.

4. Guarantor’s obligations hereunder (a) shall be unconditional, irrespective of the enforceability of the Lease or any other circumstance which might otherwise constitute a discharge of a guarantor or Tenant at law or in equity; (b) shall be primary; (c) shall not be conditioned upon Landlord’s pursuit of any remedy which it has against Tenant or any other person; and (d) shall survive and shall not be diminished, impaired or delayed in connection with (i) any bankruptcy, insolvency, reorganization, liquidation or similar proceeding relating to Tenant, its properties or creditors or (ii) any transfer, assignment or termination of Tenant’s interest under the Lease.

5. All rights and remedies of Landlord under this Guaranty, the Lease, or by law are separate and cumulative, and the exercise of one shall not limit or prejudice the exercise of any other such rights or remedies. Any waivers or consents by Guarantor as set forth in this Guaranty shall not be deemed exclusive of any additional waivers or consents by Guarantor which may exist in law or equity. Further, if Tenant assigns the Lease, with or without Landlord’s consent pursuant to section 16 of the Lease Agreement, this Guaranty shall remain in full force and effect.

6. Guarantor hereby waives trial by jury in any action brought by Landlord under or by virtue of this Guaranty. This covenant is made by Guarantor as a further inducement to Landlord to enter into the Lease.

7. Guarantor agrees to deliver to Landlord a written instrument, duly executed and acknowledged certifying that this Guaranty is in full force and effect, that Landlord is not in default (if this is in fact the case) in the performance of any of its obligations under the Lease and stating any other fact or certifying any other condition reasonably requested by Landlord or its assignees or by any mortgagee or prospective mortgagee or their assignees or by any purchaser of the property which is the subject of the Lease or any interest in such property including, but not limited to, stating that it is understood that such written instrument may be relied upon by any of the foregoing parties. The foregoing instrument shall be furnished within ten (10) days after receipt of Landlord’s written request which may be made at any time and from time to time and shall be addressed to Landlord and any mortgagee, prospective mortgagee, purchaser or other party specified by Landlord.

8. Guarantor, at any time and from time to time after Landlord’s written request, agrees to promptly furnish reasonable financial information to Landlord’s mortgagee, prospective mortgagee, assignee or purchaser. The foregoing notwithstanding, Guarantor shall not be required to provide financial information if Guarantor continues to file financial statements with the U.S. Securities and Exchange Commission.

9. In the event Guarantor pays any sum to or for the benefit of Landlord pursuant to this Guaranty, Guarantor shall have no right of contribution,

2

indemnification, exoneration, reimbursement, subrogation or other right or remedy against or with respect to Tenant, any other guarantor, or any collateral, whether real, personal or mixed, securing the obligations of Tenant to Landlord, and Guarantor hereby waives and releases all and any such rights which it may now or hereafter have. The provisions of the previous sentence shall not apply at such time as Landlord has been paid in full for all amounts owing under the Lease.

10. If Guarantor advances any sums to Tenant or its successors or assigns or if Tenant or its successors or assigns shall hereafter become indebted to Guarantor, such sums and indebtedness shall be subordinate in all respects to the amounts then or thereafter due and owing to Landlord by Tenant; provided, however, that Tenant shall be entitled to repay Guarantor under such indebtedness or advance so long as Tenant is not in breach of its obligations under the Lease.

11. This Guaranty shall be binding upon Guarantor, and Guarantor’s heirs, administrators, executors, successors and assigns, and shall inure to the benefit of Landlord and its heirs, successors and assigns. Without limiting the generality of the preceding sentence, Guarantor specifically agrees that this Guaranty may be (a) freely assigned by Landlord and (b) enforced by Landlord’s mortgagee.

12. The liability of the Guarantor hereunder, if more than one, shall be joint and several. For purposes of this instrument the singular shall be deemed to include the plural, and the neuter shall be deemed to include the masculine and feminine, as the context may require.

13. If any provision of this Guaranty is held to be invalid or unenforceable by a court of competent jurisdiction, the other provisions of this Guaranty shall remain in full force and effect and shall be liberally construed in favor of Landlord in order to effect the provisions of this Guaranty.

14. Guarantor agrees that this Guaranty shall be governed by and construed according to the laws of the State in which the Premises are located and that Guarantor is subject to the jurisdiction of the Court of the County or relevant political subdivision in which the Premises are located.

IN WITNESS WHEREOF, Guarantor has caused this Guaranty to be duly executed, under seal, as of the day and year first above written.

| INFUSYSTEM HOLDINGS, INC. | ||

| By: | /s/ Jonathan P. Foster | |

| Print Name: | Jonathan P. Foster | |

| Print Title: |

Chief Financial Officer | |

3

EXHIBIT E

EXHIBIT “E”

FAIR MARKET RENT

(a) Provided that Landlord has not given Tenant notice of an existing uncured default more than two (2) times in the immediately preceding twelve (12) month period, that there then exists no uncured Event of Default by Tenant under this Lease, nor any event for which Tenant has received written notice that with the passage of time would constitute an Event of Default, or that Tenant has abandoned or surrendered the Premises, and that Tenant is the sole occupant of the Premises, Tenant shall have the right and option to extend the Term of this Lease for the First (5-year) Option term, as described in the Lease, exercisable by Tenant by giving Landlord prior written notice (also as described in the Lease), on or before that date (April 1, 2019) that is six (6) months prior to the Expiration Date of the Original Lease term (September 30, 2019), of Tenant’s election to extend the term of this Lease; it being agreed that time is of the essence and that, except as provided for in section 16 of the Lease, this Option is personal to Tenant, and is non-transferable to any other assignee or to any sublessee (regardless of whether any such assignment or sublease was made with or without Landlord’s consent) or other party.

(b) Provided that Landlord has not given Tenant notice of an existing uncured default more than two (2) times in the immediately preceding twelve (12) month period, that there then exists no uncured Event of Default by Tenant under this Lease, nor any event for which Tenant has received written notice that with the passage of time would constitute an Event of Default, or that Tenant has abandoned or surrendered the Premises, and that Tenant is the sole occupant of the Premises, Tenant shall have the right and option to extend the Term of this Lease for the Second (5-year) Option term, as described in the Lease, exercisable by Tenant by giving Landlord prior written notice (also as described in the Lease), on or before that date (April 1, 2024) that is six (6) months prior to the Expiration Date of the First Lease term (September 30, 2024), of Tenant’s election to extend the term of this Lease; it being agreed that time is of the essence and that, except as provided for in section 16 of the Lease, this Option is personal to Tenant and is non-transferable to any other assignee or to any sublessee (regardless of whether any such assignment or sublease was made with or without Landlord’s consent) or other party.

(c) such extensions shall be under the same terms and conditions as provided in this Lease, including the requirements of Section 37 of the Lease, except as follows:

(i) the First Option term shall begin on the day (October 1, 2019)after the Expiration Date of the Original Lease term (September 30, 2019) and thereafter the Expiration Date (September 30, 2024) shall be deemed to be the date that is Five (5) years after the Expiration Date of the Original Lease term;

(ii) the Second Renewal term shall begin on the day (October 1, 2024)after the Expiration Date of the First Option term (September 30, 2024) and

1

thereafter the Expiration Date (September 30, 2029) shall be deemed to be the date that is Five (5) years after the Expiration Date (September 30, 2024) of the First Option term; there shall be no further options to extend; and