| 1 September 2007 Investor Presentation HAPC, Inc. |

| 1 September 2007 Investor Presentation HAPC, Inc. |

2 Disclosure The attached presentation was filed with the U.S. Securities and Exchange Commission (“SEC”) as part of the Form 8-K filed by HAPC, Inc. (“HAPC”) on September 18, 2007. HAPC is holding presentations for its stockholders regarding its purchase of InfuSystem, Inc. (“InfuSystem”). A copy of the complete presentation is available at the SEC’s website (http://www.sec.gov). This presentation has been prepared solely by HAPC. Neither InfuSystem nor its affiliates (including its parent, I-Flow Corporation) have approved or are responsible for the presentation information. HAPC and its directors, executive officers, affiliates may be deemed to be participants in the solicitation of proxies for the special annual meeting of HAPC’s stockholders to be held to approve this transaction on September 26, 2007. The directors and officers of HAPC have interests in the merger, some of which may differ from, or may be in addition to those of the respective stockholders of HAPC generally. Stockholders of HAPC and other interested persons are advised to read, HAPC’s definitive proxy statement filed with the SEC on August 8, 2007 in connection with HAPC’s solicitation of proxies for the special annual meeting to approve the acquisition because the definitive proxy statement contains important information. Such persons can also read HAPC’s periodic reports filed with the SEC, for more information about HAPC, its officers and directors, and their interests in the successful consummation of this business combination. Information about the directors and officers of InfuSystem as well as updated information about the directors and officers of HAPC is included in the definitive proxy statement. On August 8, 2007 the definitive proxy statement was mailed to stockholders of record as of August 6, 2007 in connection with the special annual meeting to vote on this transaction. Stockholders and other interested persons may also obtain a copy of the definitive proxy statement, and other periodic reports filed with the SEC, without charge, by visiting the SEC’s Internet site at (http://www.sec.gov). |

3 Safe harbor This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, about HAPC, InfuSystem and their combined business after completion of the proposed transaction. Forward-looking statements are statements that are not historical facts. Such forward-looking statements, based upon the current beliefs and expectations of HAPC’s management, are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: continuous infusion treatment protocol trends, including factors affecting supply and demand; labor and personnel relations; healthcare payor reimbursement risks affecting HAPC’s revenue and profitability; conditions in financial markets that impact HAPC’s ability to obtain capital to finance capital expenditures; changing interpretations of generally accepted accounting principles; and general economic conditions, as well as other relevant risks detailed in HAPC’s filings with the SEC, including the definitive proxy statement filed with the SEC on August 8, 2007 in connection with the acquisition of InfuSystem and HAPC’s form 10-K for the fiscal year ended December 31, 2006. The information set forth herein should be read in light of such risks. HAPC assumes any obligation to update information contained in this presentation. This presentation contains disclosures of EBITDA for certain periods, which may be deemed to be non-GAAP financial measures within the meaning of Regulation G promulgated by the SEC. Management of HAPC believes that EBITDA, or earnings before interest, taxes, depreciation and amortization are appropriate measures of evaluating operating performance and liquidity, because they reflect the resources available for strategic opportunities including, among others, investments in the business and strategic acquisitions. The disclosure of EBITDA may not be comparable to similarly titled measures reported by other companies. EBITDA should be considered in addition to, and not as a substitute for, or superior to, operating income, cash flows, revenue, or other measures of financial performance prepared in accordance with generally accepted accounting principles. A reconciliation of EBITDA to Net Income is included on the ‘EBITDA Reconciliation’ page of this presentation. |

4 Agenda Summary Financials and valuation Growth strategy InfuSystem overview Industry overview Overview |

5 Acquisition details Buyer: HAPC, Inc. (OTCBB: HAPN, HAPNW, HAPNU) is a blank check company (SPAC) formed for the purpose of acquiring one or more operating businesses in the healthcare sector Target: InfuSystem, Inc., (a subsidiary of I-Flow Corporation, NASDAQ: IFLO), a leading provider of ambulatory infusion pump management services to oncologists and their patients in the United States Consideration1: $85 million cash $15 million debt Record date: August 6, 2007 Shareholder vote: September 26, 2007 Anticipated acquisition closing: September 28, 2007 1 On September 12, 2007, HAPC, Iceland Acquisition Subsidiary, Inc., InfuSystem and I-Flow entered into a non-binding Memorandum of Intent (the “MOI”) which contemplates an amendment to the Stock Purchase Agreement, dated as of September 29, 2006, by and among the foregoing parties, pursuant to which the original purchase price payable by HAPC to I- Flow for InfuSystem would decrease from $140,000,000 to $100,000,000. The cash portion of the purchase price payable to I-Flow will remain at $85,000,000, less the amount returned to stockholders of HAPC exercising their conversion rights as described in HAPC’s Definitive Proxy Statement. HAPC will also deliver a promissory note to I-Flow, the amount of which will range from $15,000,000 to $35,000,000 depending upon the number of HAPC stockholders who exercise their conversion rights. The MOI contemplates that HAPC would pay contingent consideration to I-Flow, provided that certain conditions related to the operations of InfuSystem’s business are met. The contingent consideration would be based upon the compound annual growth rate, or “CAGR”, of HAPC’s consolidated revenues over the three-year period ended December 31, 2010 and would be paid in 2011. No additional payment will be made unless HAPC achieves a revenue CAGR of at least 40% over the three-year period. The payment will range from $3,000,000 to $12,000,000 depending upon the extent to which revenue CAGR for the three-year period exceeds 40%. The maximum potential amount of the contingent consideration is $12,000,000 and would be payable to I-Flow if HAPC achieves a revenue CAGR of 50% over the three-year period. The parties to the MOI have not yet amended the Stock Purchase Agreement to reflect the contemplated changes in the consideration payable by HAPC to I-Flow for the acquisition of InfuSystem, nor are the parties under any obligation to enter into such an amendment. |

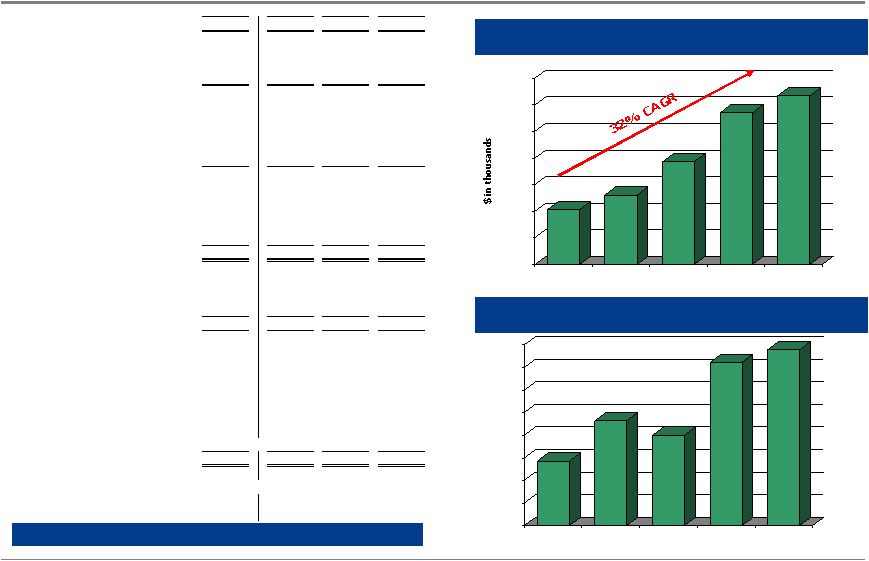

6 Investment highlights Nation’s largest continuous chemotherapy infusion services (DME) company in a high growth, highly fragmented market High barriers to entry – 60% penetration of oncology offices – Contracts with managed care organizations representing 125 million covered lives Significant near-term opportunities to expand to other cancer treatments and beyond (+25% growth anticipated) 32% revenue CAGR (5 year) without new initiatives and currently no meaningful marketing efforts Significant margins (2006) – Gross margin: 73% – EBITDA margin: 49% High return on invested capital |

7 Agenda Summary Financials and valuation Growth strategy InfuSystem overview Industry overview Overview |

8 Continuous infusion cancer treatment Continuous Infusion (CI) allows for gradual administration of chemotherapy via a small portable pump over several days as opposed to traditional chemotherapy treatments given in a single high dose over a short period of time (known as bolus infusion) CI has achieved increased acceptance and is becoming a market standard of care for colorectal cancer (CRC) due to: – Increased efficacy and comfort for patients (lower toxicity) – Lower cost compared with hospitalization or home care – Higher margin to physicians due to changes in Medicare reimbursement In 2004, sanofi-aventis and Pfizer introduced CRC treatment protocols FOLFOX and FOLFIRI, which include courses of CI. Their marketing efforts have helped to increase physician awareness of CI. There are currently over 120 CI drug therapy clinical trials in progress Recent drug protocol approvals for head and neck, lung, pancreatic, gastric and other cancers |

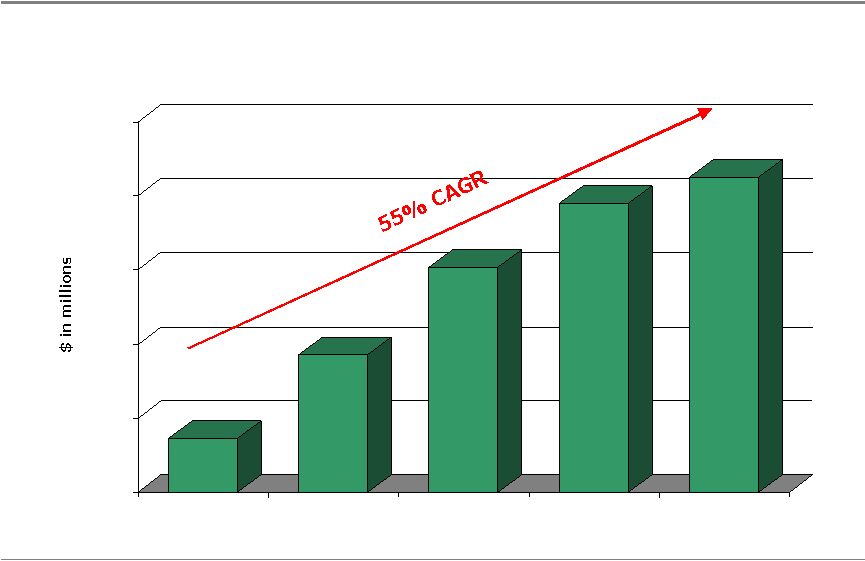

9 $368 $932 $1,517 $1,948 $2,127 $0 $500 $1,000 $1,500 $2,000 $2,500 2002 2003 2004 2005 2006 Representative growth of continuous infusion Source: sanofi-aventis Sales of Oxaliplatin (used in continuous infusion protocol)¹ 1 sanofi-aventis’ Eloxatin (oxaliplatin) – utilized in FOLFOX protocol in conjunction with continuous infusion of 5-FU

(fluorouracil) |

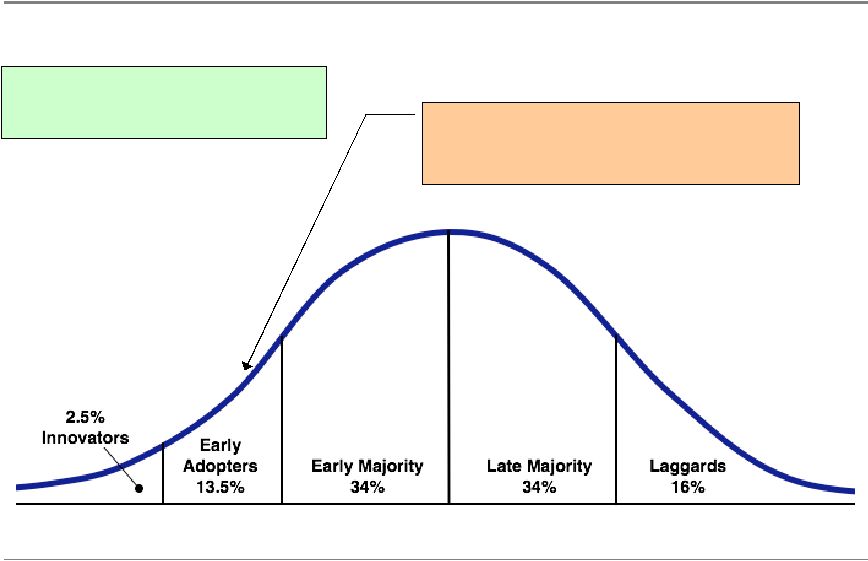

10 Market acceptance of CI growing and accelerating Source: Everett Rogers Diffusion of Innovations model InfuSystem’s early adopters and innovators consist of 5 of the top 10 cancer centers in the US Estimated position of continuous infusion for cancer treatment |

11 Near-term opportunities for continuous infusion in cancer 17,500 – CRC 6,000 – Other indications Potential continuous infusion market that requires no additional regulatory approval and minimal payor approval $40mm 20,000 CRC – Stage II (high risk) $494mm 247,030 Total $43mm 21,260 Gastric $74mm 37,170 Pancreatic $35mm 17,600 Head & Neck (Neoadjuvant) $53mm 26,400 Head & Neck (Chemo & RT) $80mm 40,000 CRC – Stage II $169mm 84,600 CRC – Stage III & IV Opportunity1 Estimated 2007 new cases Cancer type Only represents near-term opportunity 1 Based on $2,000 revenue per year per case Patients using InfuSystem pumps |

12 Agenda Summary Financials and valuation Growth strategy InfuSystem overview Industry overview Overview |

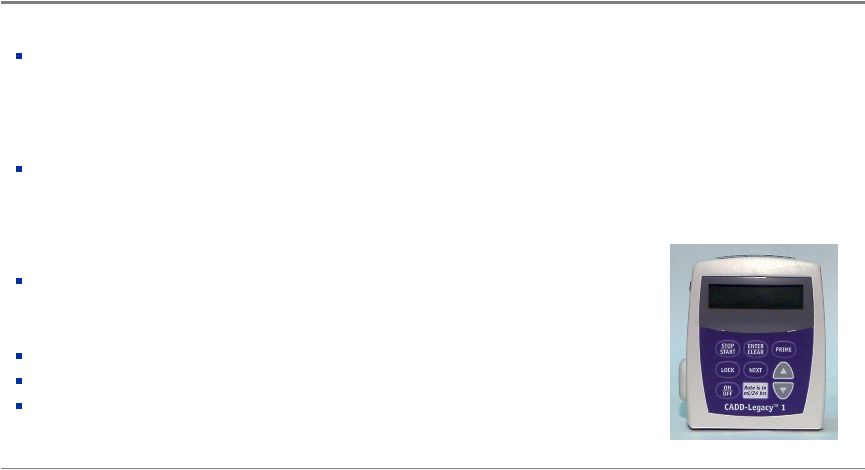

13 InfuSystem overview Leading healthcare services company that provides ambulatory infusion pumps for oncologists and their patients in the U.S. – Pumps are primarily used for the continuous infusion (CI) of chemotherapy drugs for patients with colorectal cancer InfuSystem provides a complete solution to doctor & patient: – Supplies equipment (pumps and related disposable supplies) – Handles billing and collection directly from the patients’ insurers and from the patients for pump and supplies – Maintains, cleans & services equipment – Supports patient or doctor inquiries with 24/7 nurse-staffed hotline InfuSystem also rents and sells other supplies to oncologists InfuSystem has 110 employees and nationwide coverage |

14 Compelling value proposition to all players Physicians Patients Payors Higher professional service fees Improved patient outcomes Strengthens relationship with patient Lower administrative burden Lower cost Improved patient outcomes Continuity of care Reduced side effects Comfort and convenience Lower cost Patients Win Payors Win Physicians Win Patients, Physicians and Payors all benefit with InfuSystem |

15 Significant competitive advantages Regional DME Providers No significant scale Limited pump selection Limited insurance contracts Hospital Hospitals unlikely to support competing hospitals Limited capital budgets Home care Takes revenue from physician office More costly for patients and payors Less convenient for patients Physician owned Durable Medical Equipment (DME) More time intensive and costly for physicians Biomed On-call Vast pump selection Covers approximately 65% of managed care lives Bulk discount on pumps Provides additional revenue stream to physicians 24-hour staffed nurse hotline to patients reduces load on physicians staff Servicing 60% of oncology practices InfuSystem operates in a highly fragmented market with the next leading competitor being a fraction of InfuSystem’s size |

16 Board and management team with deep healthcare expertise Sean McDevitt, Chairman – Alterity Partners, founder (sold to FTN Midwest) – Goldman Sachs, investment banking – Pfizer, sales & marketing – U.S. Army Rangers, Captain (decorated) Wayne Yetter, Director – Verispan, CEO – Odyssey Pharmaceuticals, President & CEO – Synavant, Chairman & CEO – Novartis Pharmaceuticals, U.S. President & CEO – Astra Merck, President & CEO – Current Board member of Noven Pharmaceuticals (NOVN), Matria Healthcare (MATR) & EpiCept (EPCT) Jean-Pierre Millon, Director – PCS Health Systems, President & CEO – Eli Lilly, various senior executive positions including President and General Manager of Lilly Japan – Current Board member of CVS/Caremark (CVS) & Cypress Bioscience (CYPB) John Voris, Director – Epocrates, Chairman (formerly CEO) – PCS Health Systems, Executive Vice President – Eli Lily, various senior executive positions – Current Board member of Oscient Pharmaceuticals (OSCI), Epocrates & Gentiae Clinical Research Steve Watkins, CEO – Co-founder of InfuSystem; serial entrepreneur – Former VP of Aventric Medical, a Midwest distributor of high tech equipment – Dallas Durable Medical Inc., Officer – American Medical Finance, President Jan Skonieczny, VP of Operations – Aventric Medical, Operations Manager – Charwood Cardiac Testing Lab, Supervisor Tony Norkus, VP of Sales – Served as VP of international and domestic sales for all equipment lines at I-Flow – Ambulatory pump products, product director – Parker Biomedical, national sales and marketing manger – I-Flow, director of sales and marketing CFO (to be determined) – Candidates identified VP of Marketing – Already working with HAPC as consultant |

17 Agenda Summary Financials and valuation Growth strategy InfuSystem overview Industry overview Overview |

18 Growth strategy Distribution of other products & services through current channel of oncologist – Drugs – Safety products – Disposables Immediate Impact Initiatives 1 Extend CI Services 2 Expand Product Portfolio 3 2008 and Beyond 4 Untapped international CI market Other cancer types Acquire regional “mom & pop” DME providers Fragmented market Companies typically have less than $10m in revenue and can be purchased at 4-6x EBITDA Increase pump utilization to 75-80% Invigorate sales force New marketing initiatives Expand deeper and wider within current base Extend to CRC stage II Head and neck, lung, pancreatic, gastric |

19 1. Immediate Impact Initiatives Goal: Increase pump utilization from 60% to 75-80% Invigorate sales force New marketing initiatives Expected Results: Decreased capex A 4% increase in pump utilization would have eliminated 2006 pump capex spending Increased EBITDA –capex (cash flow) 75% pump utilization would allow for 2007 revenue growth of 27% with no additional capex (a savings of over $7 million) Pump utilization --> 65% 70% 75% 80% Potential Pump Revenue $34,503,313 $37,157,414 $39,811,515 $42,465,616 Potential Revenue Growth 10% 19% 27% 36% Capex savings $2,366,118 $4,732,237 $7,098,355 $9,464,473 Estimated 2007 revenue supported with no additional capex |

20 2. Extend CI services Goal: Expand deeper & wider within current established base of oncologists Extend continuous infusion services to CRC Stage II & other cancers indications – Other cancers are a growing part of InfuSystem’s business – Recent drug protocol approvals for head and neck, lung, pancreatic, gastric and other cancers Expected Results: Sustained long-term financial performance – + 25% revenue growth – + 40% EBITDA margins |

21 Agenda Summary Financials and valuation Growth strategy InfuSystem overview Industry overview Overview |

22 InfuSystem financial performance +40% Adjusted EBITDA margins $10,292 $13,022 $19,349 $28,525 $31,716 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 2002 2003 2004 2005 2006 Revenue 26,424 27,320 26,996 28,621 28,893 25,000 25,500 26,000 26,500 27,000 27,500 28,000 28,500 29,000 Q1'06 Q2'06 Q3'06 Q4'06 Q1'07 Total patient billings InfuSystem Q1 '07 2006 2005 2004 Net rental revenue 7.9 31.7 28.5 19.3 Revenue growth 2% 11% 47% 49% Cost of revenues 2.3 8.5 7.7 5.6 Gross profit 5.6 23.3 20.8 13.8 Gross margin 71% 73% 73% 71% Selling & marketing exp. 1.0 3.8 4.3 3.2 G&A expense 1.8 7.2 7.1 4.7 Bad debt expense 1.7 4.0 1.3 1.3 Operating income 1.0 8.2 8.1 4.7 Operating margin 12.9% 25.8% 28.3% 24.0% Interest expense 0.0 0.1 0.1 0.0 Income before income taxes 1.0 8.1 8.0 4.6 Income tax expense 0.4 3.1 2.9 1.7 Net income 0.6 5.0 5.1 2.9 EBITDA calculation: Operating income 1.0 8.2 8.1 4.7 Depr. & amort. 1.0 3.7 3.3 1.8 EBITDA 2.0 11.9 11.3 6.5 Adjusted EBITDA calculation: EBITDA 2.0 11.9 11.3 6.5 Stock based comp. 0.1 0.4 1.1 0.3 MI sales & use tax accrual 0.1 0.2 0.2 0.1 Bad debt exp. due to BCBS billing delays 1.0 2.0 - - Proforma revenue from transition services agreement 0.2 1.1 0.7 0.3 Adjusted EBITDA 3.4 15.6 13.3 7.2 Adjusted EBITDA margin 43.2% 49.1% 46.7% 37.0% Adjusted EBITDA less capex 2.1 11.9 5.3 0.5 Adjusted EBITDA less capex growth NA 125% 1030% NA |

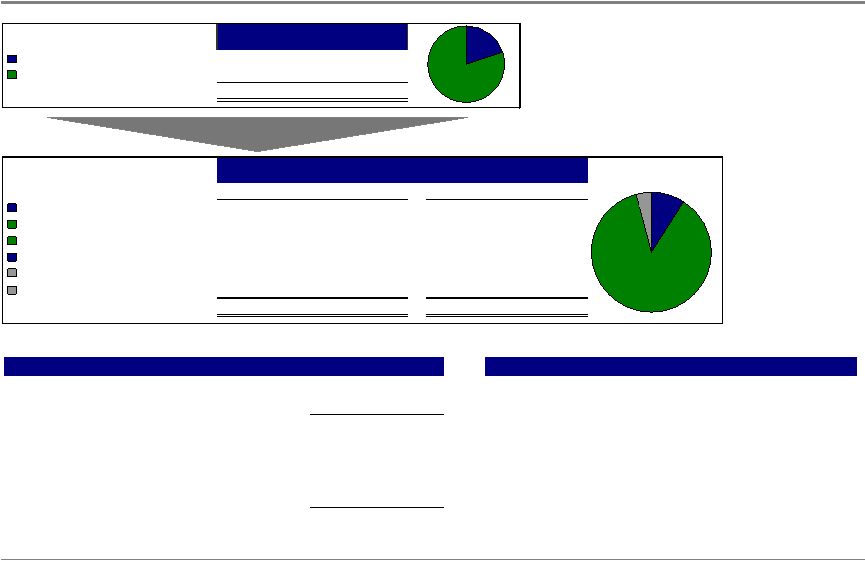

23 Structure and valuation Officers and Directors 4,166,667 20% HAPN Public Stockholders 16,875,251 80% Total Shares Outstanding 21,041,918 100% Officers and Directors 4,166,667 20% 4,166,667 7% HAPN Public Stockholders 16,875,251 80% 16,875,251 29% Warrants - - 33,750,502 58% Management Warrants 1,071,429 2% UPO Shares - - 833,333 1% UPO Warrants - - 1,666,666 3% Total Shares Outstanding 21,041,918 100% 58,363,848 100% Pre-Merger Post-Merger Basic Fully-Diluted 80% 20% 87% 9% 4% HAPN price per share in trust (2007Q2) $5.94 2006 Proforma EBITDA $15,574,550 Pro forma basic shares outstanding 21,041,918 Market Capitalization $125,017,005 EV/2006 Proforma EBITDA 10.5x Plus: in-the-money warrant value $32,778,972 Peer Group: Plus: debt (assuming no redemptions) $15,000,000 EV/2006 EBITDA 20.7x Less: cash ($10,000,000) Implied Enterprise Value $162,795,976 Post-Transaction Metrics Implied Transaction EV Multiples |

24 Public company comparables Source: Reuters & Capital IQ Note: Market cap & enterprise value calculated as of 8/17/07 on a fully diluted basis * Currently in the process of being acquired by Walgreens Corp. High Growth/Margin Healthcare Companies ($ in millions) Market Enterprise Revenue Growth EBITDA Margin EV / Revenue EV / EBITDA Company Ticker Cap Value 2007P 2008P 2007P 2008P 2006A 2007P 2008P 2006A 2007P 2008P Healthways, Inc. HWAY 1,854 $ 2,112 $ 51% 29% 21% 23% 4.8x 3.1x 2.5x 21.8x 14.3x 10.6x HMS Holdings Corp. HMSY 641 647 65% 15% 27% 29% 7.6 4.6 4.0 34.1 17.0 13.8 Integra LifeSciences Holdings Corp. IART 1,446 1,775 31% 13% 22% 23% 4.2 3.2 2.9 19.3 15.0 12.2 Matria Healthcare Inc. MATR 580 876 6% 10% 23% 24% 2.6 2.4 2.2 11.6 10.6 9.1 NightHawk Radiology Holdings, Inc. NHWK 625 606 71% 39% 29% 30% 6.6 3.8 2.8 18.1 13.1 9.2 Option Care, Inc. * OPTN 719 823 24% 14% 7% 7% 1.2 1.0 0.9 19.3 15.5 13.2 Mean 41% 20% 21% 23% 4.5x 3.0x 2.5x 20.7x 14.3x 11.4x Median 41% 14% 22% 24% 4.5 3.2 2.6 19.3 14.6 11.4 High 71% 39% 29% 30% 7.6 4.6 4.0 34.1 17.0 13.8 Low 6% 10% 7% 7% 1.2 1.0 0.9 11.6 10.6 9.1 |

25 Agenda Summary Financials and valuation Growth strategy InfuSystem overview Industry overview Overview |

26 Summary Business historically run for cash will be free to grow Significant near-term opportunities for growth with minimal execution risk Achievable growth strategy Increase pump utilization to 75-80% Extend CI services Expand coverage Use of leverage in purchase price will increase ROE High margin business with high barriers to entry |