June 2007

Investor Presentation Discussion of Proxy Materials HAPC, Inc. Exhibit 99.1 |

June 2007

Investor Presentation Discussion of Proxy Materials HAPC, Inc. Exhibit 99.1 |

Disclosure

The attached presentation was filed with the Securities and Exchange Commission

(“SEC”) as part of the Form 8–K filed by HAPC, Inc. (“HAPC”) on

June 6, 2007. HAPC is holding presentations for its stockholders regarding its purchase

of InfuSystem, Inc. (“InfuSystem”). A copy of the complete presentation is available at the SEC’s website (http://www.sec.gov). This presentation has been prepared solely by HAPC. Neither

InfuSystem nor its affiliates (including its parent, I-Flow Corporation) have approved or are responsible for the presentation

information. HAPC and its directors, executive officers, affiliates may be deemed to be

participants in the solicitation of proxies for the special meeting of HAPC’s

stockholders to be held to approve this transaction. The directors and officers of HAPC

have interests in the merger, some of which may differ from, or may be in addition to those of the respective stockholders of HAPC generally. Stockholders of HAPC and other interested persons are advised to read, when available, HAPC’s proxy statement in connection with HAPC’s solicitation of proxies for

the special meeting to approve the acquisition because this proxy statement will contain

important information. Such persons can also read HAPC’s periodic reports filed

with the SEC, for more information about HAPC, its officers and directors, and their

interests in the successful consummation of this business combination. Information about the directors and officers of InfuSystem as well as updated information about the directors and officers of HAPC will

be included in the definitive proxy statement. The definitive proxy statement will be

mailed to stockholders as of a record date to be established for the purpose of

convening a special meeting to vote on this transaction. Stockholders and other

interested persons will also be able to obtain a copy of the definitive proxy statement, and

other periodic reports filed with the SEC, without charge, by visiting the SEC’s

Internet site at (http://www.sec.gov). |

Safe harbor

This presentation may contain forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, about HAPC, InfuSystem and their combined

business after completion of the proposed transaction. Forward-looking statements

are statements that are not historical facts. Such forward-looking statements, based upon the current beliefs and expectations of HAPC’s management, are subject to risks and uncertainties, which could cause

actual results to differ from the forward-looking statements. The following factors,

among others, could cause actual results to differ from those set forth in the

forward-looking statements: continuous infusion treatment protocol trends, including factors affecting supply and demand; labor and personnel relations; healthcare payor reimbursement risks affecting HAPC’s

revenue and profitability; conditions in financial markets that impact HAPC’s

ability to obtain capital to finance capital expenditures; changing interpretations of generally accepted accounting principles; and general economic conditions, as well as other relevant risks detailed in HAPC’s filings with the SEC, including the final prospectus relating to HAPC’s

IPO dated April 11, 2006. The information set forth herein should be read in light of

such risks. HAPC assumes any obligation to update information contained in this

presentation. This presentation contains disclosures of EBITDA for certain periods,

which may be deemed to be non–GAAP financial measures within the meaning of

Regulation G promulgated by the SEC. Management of HAPC believes that EBITDA, or earnings before interest, taxes, depreciation and amortization are appropriate measures of evaluating operating

performance and liquidity, because they reflect the resources available for strategic

opportunities including, among others, investments in the business and strategic

acquisitions. The disclosure of EBITDA may not be comparable to similarly titled measures reported by other companies. EBITDA should be considered in addition to, and not as a substitute for, or superior to,

operating income, cash flows, revenue, or other measures of financial performance

prepared in accordance with generally accepted accounting principles. A reconciliation of EBITDA to Net Income is included on the ‘EBITDA Reconciliation’ page of this presentation. |

Acquisition

details Buyer: HAPC, Inc. (OTCBB: HAPN, HAPNW, HAPNU) Target: InfuSystem, Inc., a leading provider of ambulatory pumps and services to medical oncologists and their patients in the United States Seller: I-Flow Corporation (NASDAQ: IFLO) Consideration: $140 million 1 (subject to certain working capital adjustments as set forth in the Stock Purchase Agreement) Anticipated closing: Third quarter of 2007 1 The purchase price will be paid by HAPC in cash or a combination of (i) a secured promissory note

(the “Promissory Note”) payable to I-Flow in a principal amount equal to $55 million plus the amount actually paid to HAPC’s stockholders who exercise their conversion

rights but not to exceed $75 million (the “Maximum Amount”) and (ii) an amount of cash purchase price equal to $65 million plus the difference between the Maximum Amount and the

actual principal amount of the Promissory Note. |

The board of

directors recommends a vote FOR each of the following proposals Proxy proposals for

shareholder vote Proposal 1: The Acquisition To approve the acquisition by Acquisition Sub of all of the issued and outstanding capital stock of

InfuSystem pursuant to the Stock Purchase Agreement, dated as of September 29, 2006, by and among I-Flow, InfuSystem, HAPC and Acquisition Sub Proposal 2: The Stock Incentive Plan Proposal To approve the adoption of the HAPC 2006 Stock Incentive Plan pursuant to which HAPC will reserve up

to 2,000,000 shares of common stock for issuance pursuant to the Plan Proposal 3: The Amendment to the Certificate of Incorporation Proposal To approve an amendment to HAPC’s amended and restated certificate of incorporation to change

HAPC’s name from “HAPC, INC.” to “InfuSystem Holdings, Inc.” Proposal 4: The election of Directors

proposal To elect the members of HAPC’s Board of Directors to serve until the 2008 annual stockholders meeting and until their successors are duly elected and qualified Proposal 5: The ratification of registered public accounting firm

proposal

To ratify the appointment of Deloitte & Touche LLP as HAPC’s registered public accounting firm for the fiscal year ending December 31, 2007 |

History of

Acquisition InfuSystem Acquisition Timeline and Future Events 09/29/06: HAPC and I-Flow enter into a stock purchase agreement for all of the issued and outstanding capital stock of InfuSystem, Inc. - HAPC will pay I-Flow an aggregate of $140 million, subject to certain working capital

adjustments - Consideration will be paid in a combination of cash and a secured promissory note, which will

range from $55 to $75 mm depending on the % of HAPC stockholders who oppose the acquisition 12/7/06: HAPC files preliminary proxy statement regarding the vote on the potential InfuSystem acquisition, adoption of a management stock incentive plan, and a change of name proposal 12/7/06 – present: HAPC files several amendments to preliminary proxy statements in response to comments from SEC Future Steps Proxy Vote: After final proxy statement is distributed, HAPC’s investors vote on acquisition.

- Assuming more than 50% of the votes cast in response to the proxy approve the merger and no

more than 20% vote against the merger, the acquisition will be approved Approval: InfuSystem becomes a wholly owned subsidiary of HAPC |

InfuSystem

Overview Subsidiary of I-Flow (NASDAQ: IFLO) The leading provider of ambulatory infusion pumps for oncologists and their patients in the

US. Its pumps are currently used primarily for the continuous infusion (CI) of

chemotherapy drugs for patients with colorectal cancer. InfuSystem intends to expand to

other cancer treatment areas. Simplifies the continuous infusion process: InfuSystem supplies the equipment (pumps and related disposables supplies) to physicians and their patients while handling the billing and

collection directly from the patients’ insurers InfuSystem has numerous advantages when compared to other CI providers, namely - It can purchase and lease pumps in bulk, thereby reducing its cost in comparison to

competitors - It provides a 24-hour staffed nurse hotline to patients using Infu products - It performs billing and administrative tasks associated with the pumps for physicians - It is the nation’s largest CI company with 60% penetration into oncology offices

|

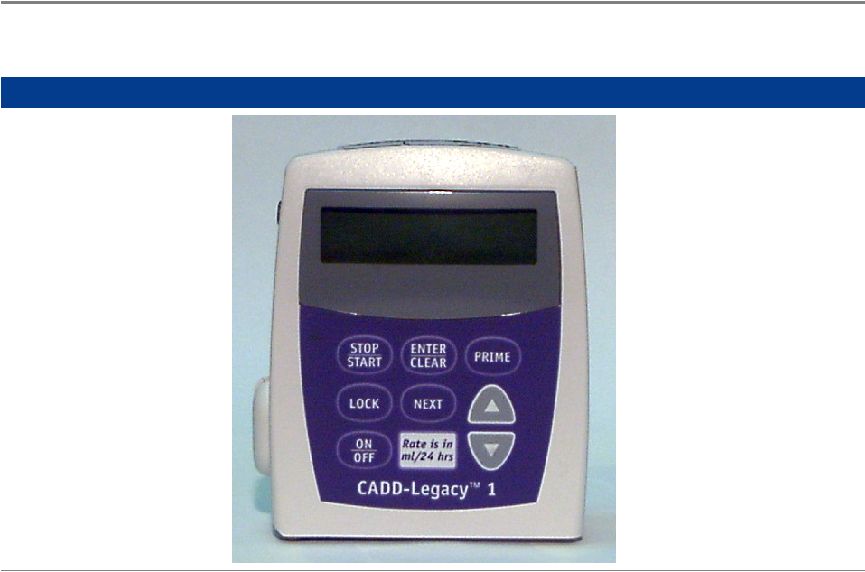

Example of

CADD-Legacy 1 Pump (Smiths Medical) Continuous infusion pumps

|

Representative examples of the variety of pumps that InfuSystem supplies Continuous infusion pumps |

Advantages of

Continuous Infusion CI allows for gradual administration of a drug via a small pump over

two to seven days as opposed to the traditional higher dose chemo treatments (bolus

treatments) given over the course of minutes or hours. - CI is an improvement in both efficacy and comfort for patients and is quickly becoming the

preferred treatment - CI benefits payors because it is generally less expensive than hospitalization or home care

- In 2004 two major drug companies released drugs used in combination with CI. They have

been marketing the products and increasing physician knowledge and prescriptions of CI

treatment. - In 2003, Medicare reimbursement laws changed so that drug payments were decreased and payments for services to physicians increased. CI requires multiple services from oncologist,

more so than traditional treatments and oral chemotherapy. This provides an economic incentive for physicians to utilize CI. - Currently over 120 drug therapy clinical trials involving CI are being carried out |

Management team

after successful completion of acquisition Steve Watkins, CEO - One of the founders of InfuSystem; started the company in 1986 - Former VP of Aventric Medical, Inc., a Midwest distributor of high tech equipment Jan Skonieczny, VP of Operations - Vice President of Operations for InfuSystem for 17 years - Previously served as office manager for Aventric Medical, Inc.; was promoted to her current position after I-Flow acquired the Company Tony Norkus, VP of Sales - Vice President of Sales for InfuSystem since 1998 - Served as VP of international and domestic sales for all equipment lines at I-Flow CFO (to be determined) - Active search currently ongoing |

Investment

highlights Leader in growing market Unique business model - Compelling value proposition - Competitive advantages Strong relationships with physician offices and payors Opportunity to expand to other cancer treatments Strong growth and profit margins |

Leader in growing

market 148,610 1 estimated new cases of colorectal cancer (“CRC”) in the U.S. in 2006 Introduction of CRC treatment protocols FOLFOX (sanofi-aventis) and FOLFIRI (Pfizer) in 2004 Continuous infusion regimens are achieving increased acceptance and are becoming a market standard chemotherapy for CRC Opportunity to enter growing markets for continuous infusion treatments for head and neck, lung, pancreatic, gastric, leukemia, non-Hodgkins lymphoma, and other cancers 1 American Cancer Society |

Representative

growth of continuous infusion Source: Arrowhead Publishers, 2006 $130 $194 $368 $932 $1,517 $1,750 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 2000 2001 2002 2003 2004 2005 Increasing usage of FOLFOX protocol - Sales of Eloxatin (Oxaliplatin) utilized in FOLFOX protocol with 5-FU and leucovorin |

Compelling value

proposition Physicians Patients Payors Professional service fees Better patient outcomes Continues relationship with patient Less administrative demands Lower costs Better patient outcomes Continuity of care Reduces side effects Comfort and convenience Lower cost |

Competitive

Advantages Regional DME Providers No significant scale Limited pump selection Limited insurance contracts Hospital Other hospitals unlikely to support competing hospitals Limited capital budgets Home care Takes revenue from physician office More costly for patients and payors Less convenient for patients Physician owned DME More time intensive and costly for physicians Biomed On-call InfuSystem is a leading national provider of ambulatory infusion pump services for the oncology specialty Services approximately 60% of oncology physician offices and hospital infusion centers |

Strong

relationships with physician offices and payors Relationships with approximately 60% of

oncology practices - Opportunity to penetrate deeper within practices (more physicians) and expand product offerings Contracts covering approximately 65% of managed care “lives” - Include Aetna, PacifiCare, Humana and others |

Expansion

opportunities Extend continuous infusion therapies to other cancers - Liver and esophageal cancer are growing parts of InfuSystem’s business - Recent drug approvals for head and neck, lung, pancreatic, gastric, leukemia, non- Hodgkins lymphoma, and other cancers - Several new drugs in development Potential distribution of other products through established medical oncologist relationships Opportunity to provide oncological drugs directly to physicians along with pumps Untapped international market for continuous infusion treatments |

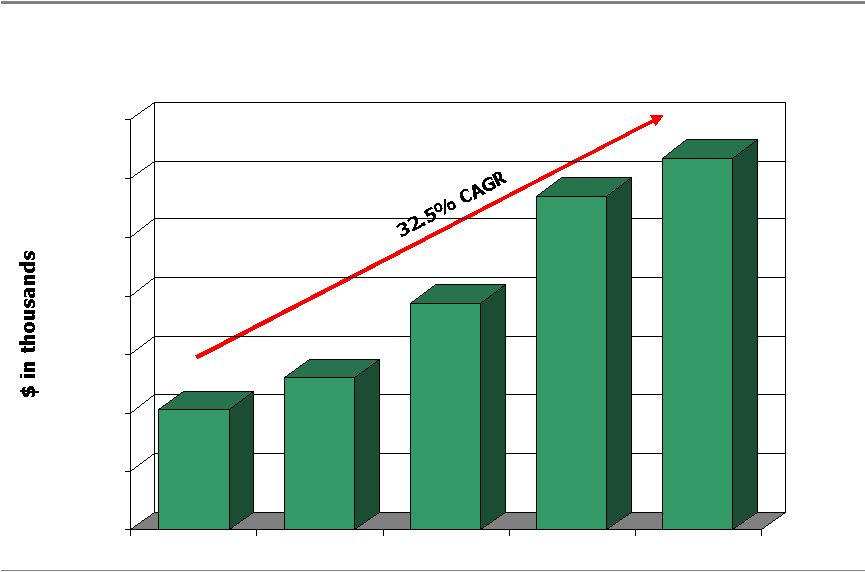

InfuSystem

Historical Revenue Performance $10,292 $13,022 $19,349 $28,525 $31,716 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 2002 2003 2004 2005 2006 |

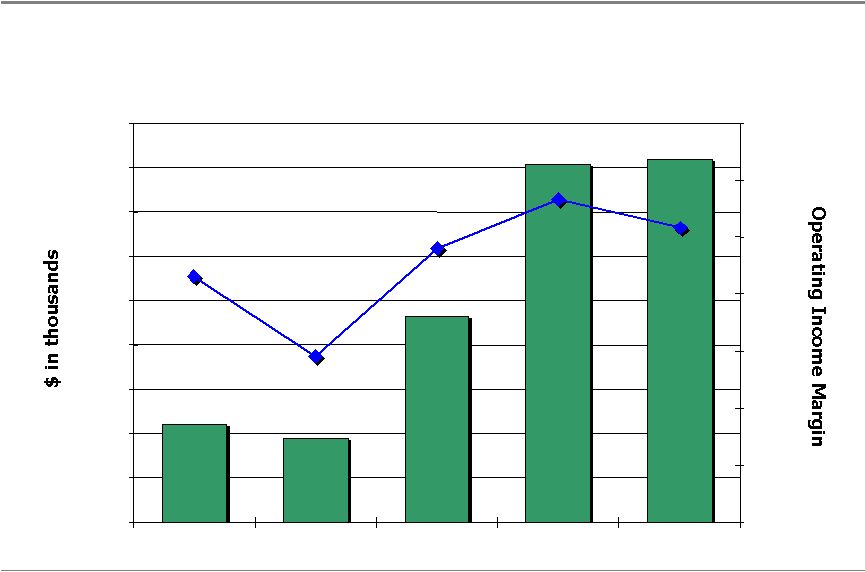

InfuSystem

Operating Income Performance $8,170 $4,652 $8,081 $2,211 $1,899 14.6% 25.8% 28.3% 24.0% 21.5% $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 2002 2003 2004 2005 2006 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% |

InfuSystem

Financial Performance USD's in millions 12/31/05 12/31/06 Revenues 28.5 $ 31.7 $ Cost of Sales 7.7 8.5 Gross Profit 20.8 23.3 Gross Margin 72.9% 73.3% Sales and Marketing 4.3 3.8 General and Administrative 8.4 11.3 Total Operating Costs 12.7 15.1 Operating Income 8.1 8.2 Operating Income Margin 28.3% 25.8% Interest Expense 0.1 0.1 Income Before Taxes 8.0 8.1 Income Tax Provision 2.9 3.1 Net Income 5.1 $ 5.0 $ Net Income Margin 17.9% 15.8% D&A 3.3 3.7 EBITDA 11.3 $ 11.9 $ Stock Based Comp 1.1 0.4 Michigan Sales & Use Tax Accrual 0.2 0.2 ProForma Revenue from Transition Service Agreement 0.7 1.1 ProForma EBITDA 13.3 $ 13.6 $ Year End |

EBITDA

Reconciliation USD's in millions 12/31/05 12/31/06 Net Income 5.1 $ 5.0 $ plus: Interest Expense 0.1 0.1 plus: Income Tax Provisions 2.9 3.1 plus: D&A 3.3 3.7 EBITDA 11.3 $ 11.9 $ plus: Stock Based Comp 1.1 0.4 plus: Michigan Sales & Use Tax Accrual 0.2 0.2 plus: ProForma Revenue from Transition Services Agreement 0.7 1.1 ProForma EBITDA 13.3 $ 13.6 $ Year End +40% EBITDA Margins in 2006 & 2005 |